FinTech

Transforming Financial Services: Fraud Detection and Risk Assessment Using AI

August 18, 2023 • 587 Views • 19 min read

Tetiana Stoyko

CTO & Co-Founder

It is hard to argue the fact, that artificial intelligence solutions are at their peak of popularity. Additionally, it is impossible to deny, that despite that most such software development as a service solutions are commonly used “just for fun” by regular users, they can be an important instrument of process automation regardless of the industry, you will apply them to.

As a matter of fact, a wide range of open-source AI powered chatbots and other accessible machine-learning models allows developers to upscale any modern software project by simply integrating a ready-made solution and adjusting it to the needs of the project. It also significantly increases the number of experienced app developers for hire, who are specialized in working with AI.

For instance, just a decade ago, to have a full-fledged working machine learning software, technological giants like Google or Apple had to spend countless resources on the development and training of AI technologies, as well as finding and hiring dedicated development teams, familiar with such technologies.

Obviously, such complex projects were developed not as software development as a service, but rather as a unique feature, proposed for the customers in terms of the original products, created and distributed by the corporations.

To sum up, just a few years ago, small fintech companies were limited in resources and access to technologies, which limited their built-in optional features. But, with the open-source nature of chatbots like ChatGPT, which can be easily integrated into almost any software product, AI started transforming various industries, and FinTech software development is not an exception.

So, what are the modern realities of AI in the financial sector, how can it help to upscale the FinTech software development industry, what is the role of machine learning in fraud detection and risk assessment, and when is it worth considering an AI integration?

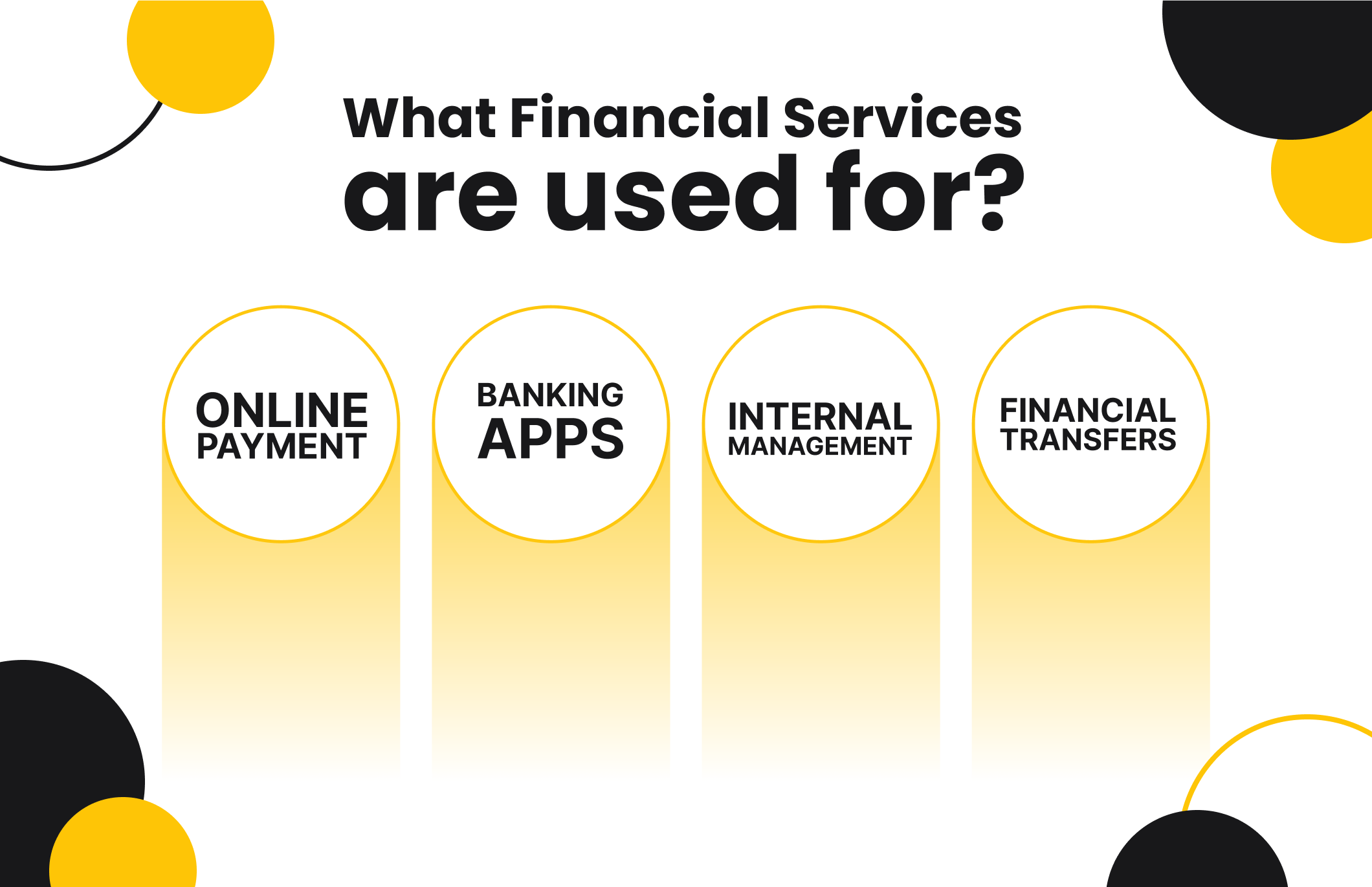

What Financial Services Are Used For?

Before going to the main topic, we have to understand the main working principles and features, proposed by financial services like DataBank.

As the name says, this software is used in the finance industry. In other words, all these technological solutions are designed specifically to work with the financial aspects and are mainly used by various institutions like banks, and investing platforms, for payment processing, risk assessment, etc.

To make it simple, these are essential aspects of the modern world, which you might never face as a client, but have to know, that these are the things, that allow people to perform and monitor financial transactions, and make it possible to use a credit card, instead of caring a thick wallet, allow you to pay via ApplePay or other banking apps in your local grocery store, etc.

Yet, there is another important fact, that is commonly forgotten - if we will oversimplify, FinTech software development services are about countless and constant financial data transfers, which must not only be processed but require a high level of data security.

To make it simple, financial services software is one of the examples of big data structures, which makes them a great choice for AI and ML integration.

Why Artificial Intelligence in FinTech?

Given the fact, that most FinTech innovative solutions have to work with big data, process countless documents and transactions and analyze them, it seems that artificial intelligence and machine learning are must-have development tools, which can significantly improve and upscale these processes. Why?

At the moment, the accessed software toolset is limited. Therefore, there is still a number of activities, which have to be performed manually by specialists.

On the other hand, AI and machine learning allow to set up of a learning environment for the software solutions like chatbots with natural language processing capabilities and enables robotic automation tools.

In fact, AI and ML solutions are much faster in processing big data according to predefined AI algorithms and avoiding human factors or possible mistakes.

So, having such financial technology in the banking industry, specialists will be able to automate particular time-consuming processes like fraud analysis or credit risk assessment, as well as other procedures.

For illustration, BlackBird.ai uses AI in the financial services industry to gather information about various service providers in this field and check their credibility, giving the appropriate assessment and comparing it to the others.

Undoubtedly, AI systems faster analyze data, compared to humans. As a result, even if there are any regulations, or limitations due to financial security policies, related to access to vulnerable data, machine learning methods still can be applied to some types of data, even if not to the whole system at once.

The only thing worth mentioning - AI is a tool for specialists, it won’t replace humans (at least, in the nearest future).

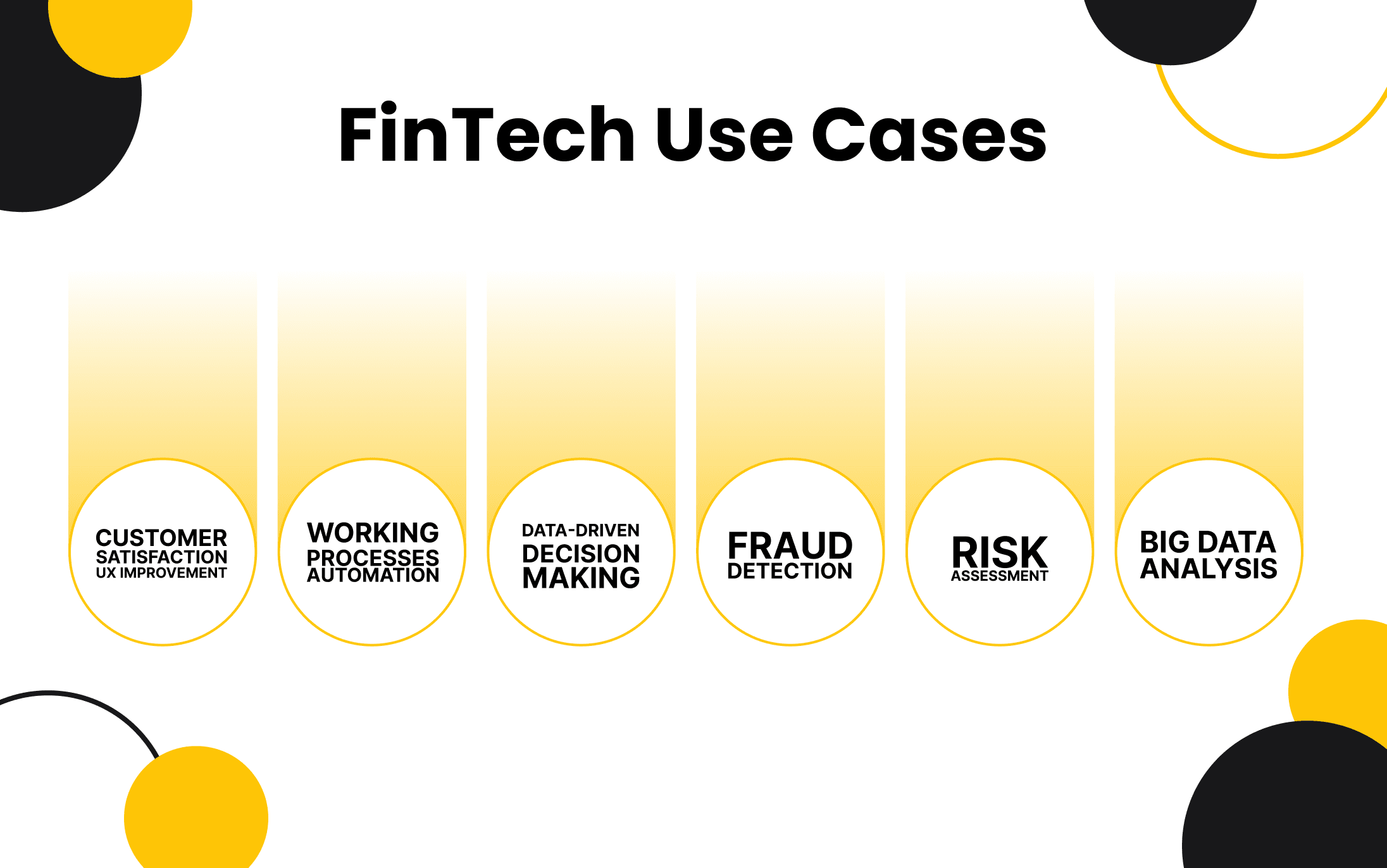

Possible Use Cases of AI in Financial Institutions

Judging from the global AI trends and use cases, it is not hard to make more accurate predictions on the potential benefits of artificial intelligence integration into the financial industry.

Improved User Experience and Better Targeting

The first and most obvious benefit of adopting AI chatbots is the possibility to improve the customer satisfaction of your clients.

As for now, most banks, as well as other financial institutions are already using chatbots for customer services, both giving them a faster response on demand and allowing companies to redirect resources like customer service teams, increasing the speed of application processing.

However, client services are not the only potential aspect to upscale. For instance, both social media and eCommerce platforms are already using AI algorithms on a daily basis, which allows them to better understand the needs of the audience and propose them personalized content, related to their preferences.

Including the fact, that AI is operated due to predefined behavior logic and machine learning algorithms, we can assume, that they can be easily integrated into numerous platforms for even better targeting. The same prediction is true for various financial services, specialized in investments.

Customer Data Analysis

Additionally, working with big data will become a much easier process with the use of artificial intelligence.

It is possible to make a more detailed and accurate conclusion on user behavior, allowing the company to better understand routine spending or preferred goods and services. As a result, if AI models will detect suspicious activity, they can alert the specialist, in order to faster respond to potential fraud or identity theft.

Data-Driven Decision Making

Having an AI on board gives financial platforms a tangible advantage over their competitors. If you will include the fact, that artificial intelligence can easily analyze terabytes of data, you can train it to make possible more accurate predictions on the market, using these AI capabilities.

As a result, you can provide your users with an alternative opinion on the potential benefits of investing money in specific assets or company securities, allowing the data-driven decision-making process and making it easier. Still, it is probably a good idea to make a disclaimer, that such financial technology is still experimental so not all of its predictions are going to come true.

Yet, it is still a great instrument, that allows investors to cut time, using automated data processing from various sources. Instead, it is possible to assume, that with a proper attitude, anyone will benefit from such advanced tools.

AI for Fraud Detection

Talking about AI in FinTech, it is worth mentioning, that analyzing data allows us to make particular conclusions and define market trends or similarities within various activities like payment processing.

So, by giving the software access to proven known fraud attempts, companies from the financial industry can train bots to identify similar suspicious transactions in the future, immediately notifying the support specialist, so they checked them as fast as possible, i.e. allows redirecting human resources to more prioritized tasks: instead of manually reviewing dozens of transactions, looking for suspicious ones, they can review the defined ones.

Risk Assessment

The same approach can be used to improve and partly automate the risk assessment. For instance, rather than involving the person in gathering the credit history of a client, which consists of historical and current data, or their payment transactions, it is possible to adjust an AI solution for such tasks.

Thus, financial experts will simply get a summary of predictive analysis from the chatbot on a particular person or company, having more time for making a more balanced decision.

How to Integrate AI in FinTech Systems?

As was mentioned before, nowadays, there is a wide range of open-source AI and ML products, which can be easily integrated into any modern software product. For instance, you can apply a similar approach, as in the case of creating a virtual assistant.

In such a scenario, you can use an advanced AI chatbot like ChatGPT under the hood to process all the requests in a text format and for more useful and convenient interaction to add extra features like image-to-text transformation.

However, ChatGPT might seem not the best solution for such an industry due to the fact, that most data to be processed is personal and vulnerable, as well as protected by various regulations like GDPR. So, alternatively, it is possible to look for ready-made specific AI solutions, designed and distributed by licensed companies.

Fortunately, nowadays the number of such AI software increases, just like in the case of Architecture and Design apps, powered by artificial intelligence. Among FinTech-specific virtual assistants, we can name:

Kasisto, a conversational AI, capable of answering client requests, which can also help fraud analysts with detection by checking the provided information and recognizing potential fraud patterns, or other suspicious activity.

Vectra, a FinTech AI, is designed to define cybersecurity threats and has great data analysis potential.

Of course, the best possible case is when you hire a dedicated team to develop a unique and personal AI or ML system, having the whole control over it. But, once again, it is still an extremely complex and resource-intense task, so small companies most likely won’t have enough time and resources to maintain such a development process.

Ethical Considerations of AI in FinTech

Frankly, it is hard to avoid the discussion on ethical considerations as well as security challenges when it comes to integrating AI powered solutions in any possible industry, especially when it comes to targeting financial institutions.

For illustration, the emergence of these new technologies resulted in countless debates about the limitations and ethical considerations of using ChatGPT. From the very beginning, this AI chatbot has proven to be a great utilitarian and extremely useful tool, which can help developers to cover some aspects of their work, starting from writing code documentation or formal letters, and ending up with code inspection and rewriting.

However, the more employees used it for automating routine tasks, the more concerned the employers become.

Most such worries were related to NDAs and the fact, that it is unclear, who has access to the data, which is sent to Chatbot for further processing. So, numerous IT companies asked their employees to pay attention to the data, they are using in their conversations with ChatGPT.

Clearly, the same concerns are true for the rest AI alternatives on the market. Even in case, when you contact a specific AI provider and sign an agreement with them, it is still unclear, how efficient AI systems are in terms of data security, not even talking about the efficiency and ethics of AI powered decision making.

Additional concerns are generated because of the unclear legal status of AI and its usage. The aforementioned GDPR has no update on the possibility to share personal data with chatbots.

To add more, it is hard for any AI development team to ensure the safety of their product, including the security of the database and all the input/output of each conversation, whether they are saved, or not.

The Answer For All Potential Challenges

To cut a long story short, there are two ways how to deal with all the foregoing.

The first one is probably easier, yet much more resource-intensive. In case you can't be sure of your possible AI vendors, but still require an AI for operational efficiency, then you simply have to find an AI development team and create your own AI in FinTech. Still, in such a scenario, you will have to include all the related drawbacks and extra spending.

Alternatively, though, it is worth spending some time contacting different vendors and discussing all the aspects, which concern you, in order to find the most suited business partner, who will meet all your requirements and will provide you with AI powered security solutions.

AI for FinTech with Incora

If you are interested in integrating AI solutions into your financial system, the first step would be to find and hire dedicated development team with a proven experience in this niche. Especially, if you have no previous experience in working with such technologies.

To find such an outsourcing software company, you have to check their case studies. For instance, Incora has some experience in providing various FinTech software development services and setting up payment gateways, including also integrating and adjusting AI for financial platforms, as well as white label app development.

Additionally, we also took part in developing other FinTech projects, using alternative technologies like blockchain for verifying digital files, enabling smart contracts within banking apps, etc.

What’s your impression after reading this?

Love it!

1

Valuable

1

Exciting

1

Unsatisfied

1

FAQ

Let us address your doubts and clarify key points from the article for better understanding.

What is fraud detection and risk assessment using AI?

Fraud detection and risk assessment using AI involves leveraging artificial intelligence and machine learning techniques to identify and prevent fraudulent activities, as well as assess potential risks within various processes, systems, or transactions.

Why is AI used for fraud detection and risk assessment?

AI can process and analyze large volumes of data much faster and more accurately than traditional methods. It can identify complex patterns, anomalies, and trends that may indicate fraudulent behavior or potential risks, thus enhancing the overall effectiveness of fraud detection and risk assessment processes.

How does AI detect fraud and assess risk?

AI algorithms use various techniques such as anomaly detection, pattern recognition, and predictive modeling to analyze historical and real-time data. These algorithms learn from both normal and abnormal behavior, enabling them to identify deviations that might indicate fraudulent activity. Risk assessment involves evaluating factors that could lead to potential problems and quantifying their likelihood and impact.

What types of data are used in AI-driven fraud detection and risk assessment?

AI algorithms utilize a wide range of data, including transaction history, user behavior, geographical information, device fingerprints, social network connections, and more. By analyzing this diverse data, AI systems can create a comprehensive view of each individual's or entity's activities.

What are the benefits of using AI for fraud detection and risk assessment?

AI provides real-time analysis, higher accuracy, reduced false positives, and the ability to adapt to evolving fraud tactics. It also helps in automating repetitive tasks, saving time and resources, and enabling businesses to proactively address potential risks.

Can AI prevent all types of fraud?

While AI is highly effective in detecting many types of fraud, it might not catch every instance. Fraudsters can adapt their tactics, making it a continuous cat-and-mouse game. AI should be used as a powerful tool alongside other security measures for comprehensive fraud prevention.

How can AI handle new and evolving fraud tactics?

AI systems can adapt and learn from new data patterns. Regular updates to the algorithms based on emerging trends and evolving fraud tactics help maintain the system's effectiveness over time.

Are AI-driven systems prone to false positives?

AI systems can be fine-tuned to reduce false positives by adjusting the detection thresholds and integrating additional contextual information into the analysis. This optimization is an ongoing process to balance accurate detection with a manageable number of false alarms.

How can businesses implement AI-based fraud detection and risk assessment?

Businesses can start by identifying their specific needs and goals, then selecting or developing AI algorithms that suit those requirements. They need to integrate these algorithms into their existing systems, provide proper training data, and continuously monitor and refine the models.

What are the ethical considerations with AI-driven fraud detection?

Ethical concerns include privacy issues related to data collection, transparency in decision-making processes, and potential biases in algorithmic decisions. Ensuring fairness, accountability, and transparency in AI systems is crucial to maintaining trust.

YOU MAY ALSO LIKE

Let’s talk!

This site uses cookies to improve your user experience. Read our Privacy Policy

Accept

Share this article