How to Integrate Cryptocurrency into Your App

July 20, 2023 • 568 Views • 17 min read

Tetiana Stoyko

CTO & Co-Founder

Undeniably, popular cryptocurrencies like Bitcoin, Ethereum, and other alternatives significantly impact modern society.

Despite the fact, that mainly they are used as valuable digital assets, primarily operated in cryptocurrency exchange operations, not as an everyday payment method. Still, at the same time, a number of various institutions like international banks or governments are planning to somehow participate in the crypto market, establish control over it, and set clear rules for the operations, enabling the possibility to create a crypto bank account to accept cryptocurrency, etc.

As for now, most cryptocurrency enthusiasts are facing numerous challenges, related to their activity, as well as the lack of law regulations in most of the world.

Frankly, it is hard to predict, when cryptocurrency payments will become a routine payment method, just like cash or credit cards. Yet, it is hard to deny, that modern blockchain-based currencies are used for payment purposes by various organizations and individuals. This is even more common for various services, that can be reached via the Internet. It also become one of the most popular modern FinTech software development trends.

Thus, instead of debating on whether cryptocurrencies will replace more traditional and hard currency, let’s make sure, that those, who are familiar with it, will get a chance to use it for online payment purposes.

But, before we will get to answering how to make a cryptocurrency exchange, and what is it better to choose: develop your own crypto payment API, or integrate ready-made APIs or other third-party SaaS software development solutions, let’s cross some t’s.

What Are Crypto Payments?

To make it simple, cryptocurrency is similar to virtual currencies, meaning, that it exists in digital format. Yet, the only important difference between them is the fact, that cryptocurrency is encrypted and is based on a specific blockchain solution. Besides, such technologies require hire dedicated development team of specialists, familiar with certain technologies.

As a result, it is much harder to trace it down and/or abort the payment transaction. Also, it is extremely difficult to steal the currency from its owner.

Summing up all the above, it is a much more protected way to perform your financial transactions. To add some more, due to the specifics of the technology, it is based on, each cryptocurrency is unique: it is not only different from traditional currencies like the US dollar but also each token is unique as well, i.e. every single conditional unit has specific properties, just like the regular banknote number.

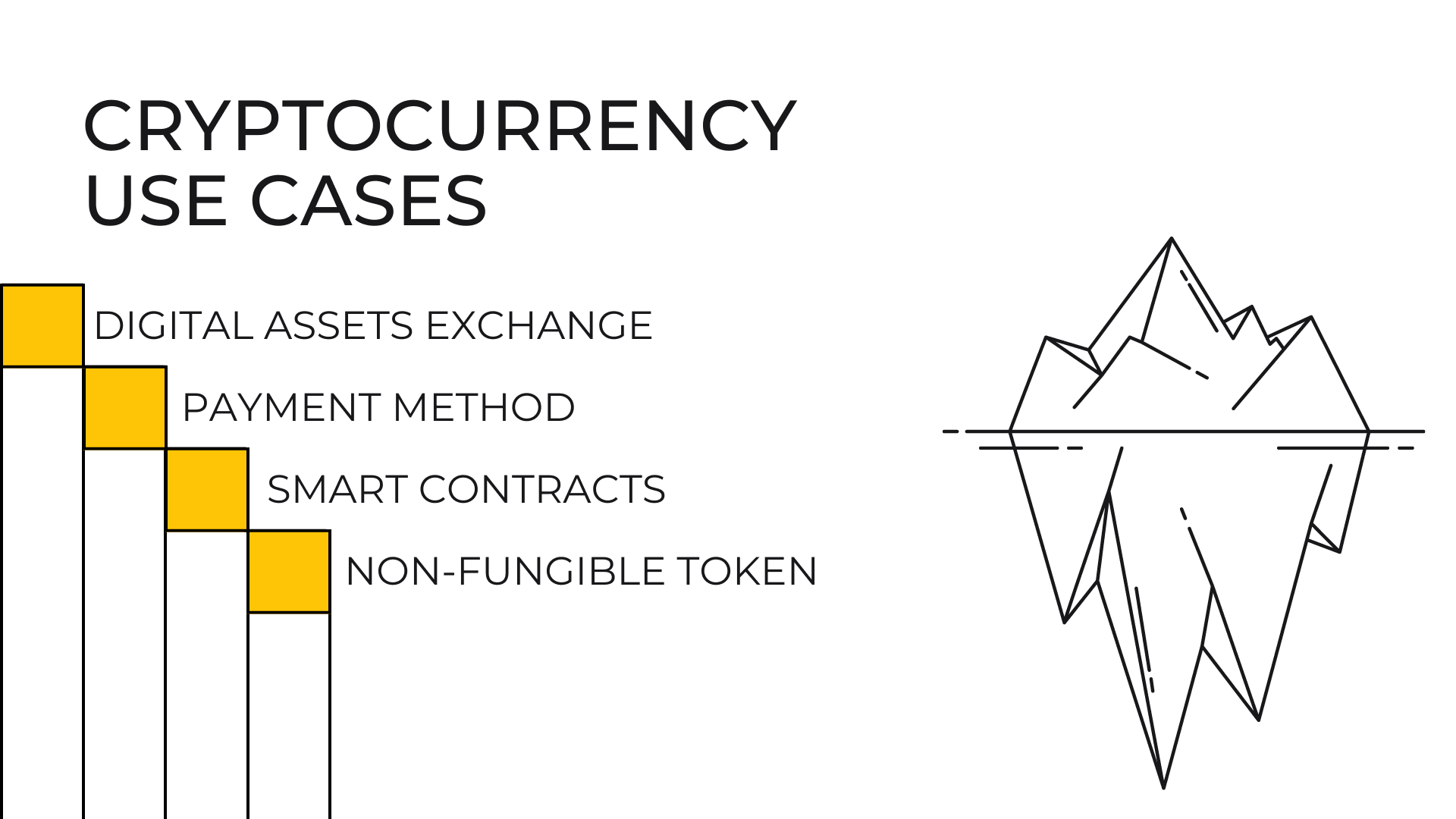

Finally, cryptocurrency exchange and use as crypto payment options - is by far not the final list of potential use purposes for cryptocurrency in the field of FinTech software development services. For instance, there is a smart contracts technology, which is used for administrative purposes and upscales the agreements between different parties.

Cryptocurrency and Multitasking: NFT Case

To show the prosperity of possible use cases for cryptocurrency, let’s take a look at NFT apps.

To make it simple, these are non-fungible tokens, which are created, or “minted” with the use of cryptocurrency and blockchain technologies. When a token is minted, it can be attached to a specific data or digital object, making it unique and allowing us to identify it.

To cut a long story short, NFT apps are the ones, which are using cryptocurrency under the hood in two totally different ways. At first, NFT items are created, making them unique and identified, allowing to track copyright, etc.

Secondly, most NFT apps are using crypto purchases as the main trading asset, i.e. as a payment method. For instance, the FinTech developers make the website accept Bitcoin. Besides, cryptocurrency transactions like Bitcoin payments are commonly used by default in this type of app.

What Do You Need to Accept Crypto Payments in the App?

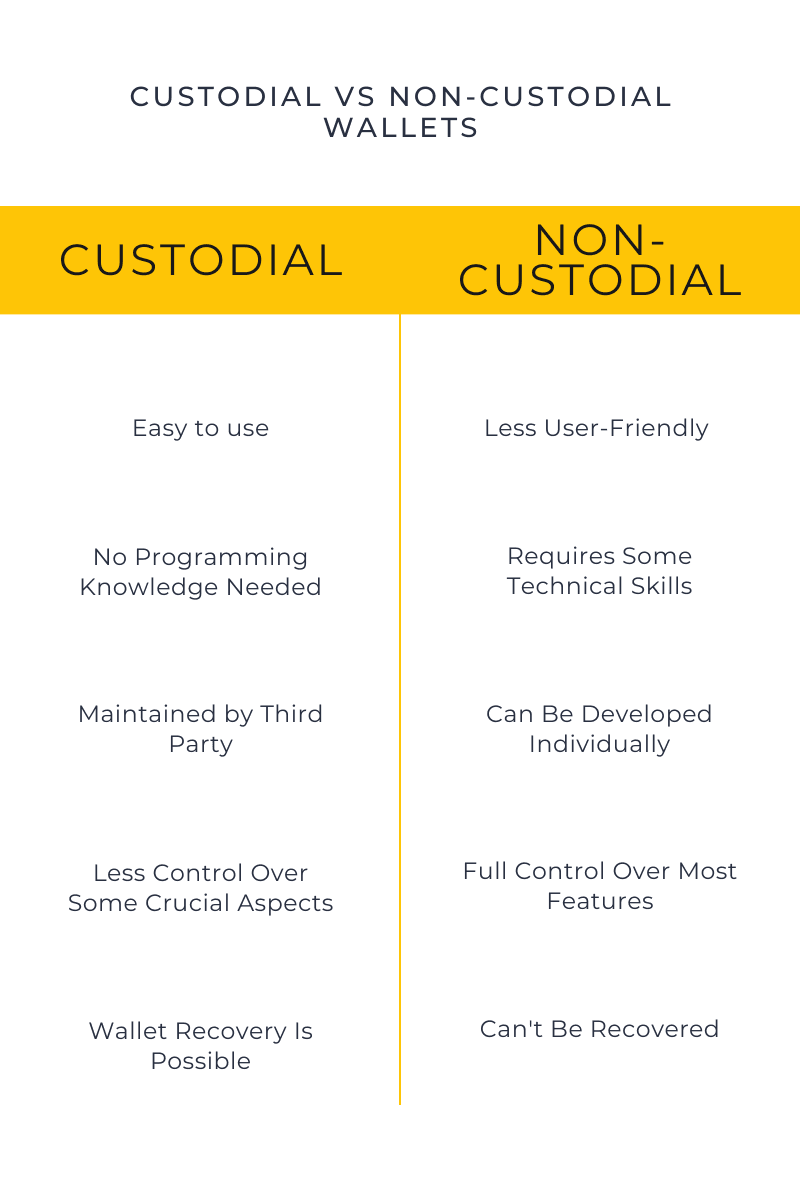

Regardless of your purpose to use your digital assets, in order to be able to interact with them, you will need a crypto wallet. If you wonder, how to build a digital wallet, we have two possible solutions: Custodial and Non-Custodial Wallets.

Custodial Wallet

It is one of the most popular types of crypto wallets. The main feature of this type of digital ledger - is its user-friendly nature, so you don't need a full-fledged dedicated software development team to create and use it.

To make it simple, it is distributed as SaaS, meaning that a third-party platform gives all the instruments for users to create their own digital wallets. On the one hand, it significantly simplifies the process of integration into the cryptocurrency industry, giving intuitive tools for setting the environment to pay with crypto, buy cryptocurrency, receive payments, and perform crypto exchanges.

Yet, there are a few potential drawbacks, related to this type of digital ledger. First of all, many such wallets are attached to a specific platform or application, allowing them to perform all the transactions within its ecosystem. Obviously, it limits the user’s possibilities to interact with the FinTech industry and to use crypto.

However, what is even more important - is the security issues. As a matter of fact, custodial wallets have the same security policies and working principles under the hood, which are similar to the non-custodial ones. But in this case, private keys and other important components, which directly impact the security, as well as the overall wallet management options - are accessible only to the owner of the platform, which proposes the possibility to create a custodial wallet.

Non-Custodial Digital Ledget

Alternatively, it is possible to develop a non-custodial ledger. It covers the foregoing drawbacks of a custodial wallet but requires more experience and technical knowledge from its users, so hiring dedicated development team will be beneficial in such circumstances.

To cut a long story short, non-custodial wallets are more advanced, when it comes to customization and management, allowing their users more options to change and adjust, which is crucial if you are going to operate it according to business logic and for your company's interests.

Still, they also are much more complex and complicated, when it comes to crypto integration and building cryptocurrency wallets.

Making Cryptocurrency Exchange App vs Integration

Eventually, let’s find out which approach is better for specific cases. And, before the discussion started, we have to admit, that regardless of whether you are considering crypto integration, or creating your own crypto platform, you will have to create your own digital ledger.

Long story short, developing a cryptocurrency exchange app is a much more resource-intensive and complicated task, which requires hiring dedicated development team of niche-experienced developers, who are familiar with the technologies to be used.

Additionally, it is worth mentioning, that such FinTech software development will take a lot of time and demands extra resources for further maintenance after the development.

Thus, if you want to develop a platform with the use of cryptocurrency and blockchain technology - the best way is to include them from the very beginning when you are developing from scratch. Otherwise, these implementations will result in the need for changing most infrastructure of your software and numerous lines of code to be rewritten.

Alternatively, cryptocurrency integration is a relatively simple and easy task, which requires just a few steps. Judging from our experience and common sense, there is a reason for existing of SaaS software development solutions and their increasing popularity.

Such software allows you to avoid unneeded spending and save resources for higher priority tasks, which impact your business logic. Clearly, most SaaS software development solutions are paid. Yet, this is still much cheaper and faster, than developing everything on your own from scratch.

Summing up all the above, we can define the main cases for developing and integrating cryptocurrency payment gateways.

- In case you are developing an application from scratch and are looking for startup projects - it might be a great idea to choose to develop cryptocurrency exchange software. Nevertheless, in this scenario, your main product will be cryptocurrency software itself.

- So, if you are looking for an extension of payment methods on your software platform, i.e. to add Bitcoin payment to your website - then it is better to choose a ready-made cryptocurrency solution.

Guide On How to Integrate Cryptocurrency Exchanges

Step 1: Choose the product to integrate

To be fair, most such ready-made software solutions integration processes are generally similar, still having some specifics and details, that are different. So, let’s consider one particular case like MetaMask for a general illustration of the cryptocurrency integration process. In case, you decide to use other similar services, you can easily find detailed instructions on their websites.

Step 2: Install Metamask extension

When we are talking about Metamask, we have to remind, that it works as a browser extension. Thus, before proceeding further with its integration, you have to install it and ask your users to do so as well. All the resources can be found on its official website.

Clearly, you will also need to create your own virtual wallet on this platform in order to be able to accept payments from clients.

Step 3: Set Up Web3 Provider

In order to interact with MetaMask from your application, make adjustments, etc, you'll need to use the Web3 API, which is a JavaScript library for interacting with Ethereum or other compatible blockchains. When MetaMask is installed, it injects the Web3 API into the browser. Check if Web3 is already available in the user's browser or provide a fallback option if it's not present.

Step 4: Connect to the Ethereum Blockchain Network

Eventually, after you have set up your cryptocurrency environment for further integration, it is time to connect to the Ethereum Network.

Usually, it is performed automatically, after installing and setting up Metamask and granting the user permission. Make sure to handle different network configurations (e.g., mainnet, testnets).

Step 5: User Permission and Access to Account

Before accessing the user's accounts or conducting transactions, your app should request the necessary permissions from MetaMask. Use ethereum.enable() method or similar to prompt the user to allow your app to connect to their MetaMask account.

Once the user has granted permission, you can access their Ethereum accounts through the Web3 provider. The user's account(s) will be available in the web3.eth.accounts array. You can use this to display the user's address or balance.

Step 6: Interact with Smart Contracts

If your app interacts with smart contracts, you'll need the contract's ABI (Application Binary Interface) and address. You can use the ABI to create a contract instance, which you can then use to call contract methods or send transactions. You'll also need to sign transactions with the user's MetaMask account to execute them on the blockchain.

Step 7: Handle Errors and Loading States

It's essential to handle various states gracefully, such as when MetaMask is not installed, the user denies permission, or the connection to the network fails. Provide meaningful error messages and loading indicators to enhance the user experience.

Step 8: Perform Testing and Ensure Security Level

During development, use testnets like Ropsten or Rinkeby to avoid spending real Ether. It allows you to test the functionality without incurring real costs.

When working with MetaMask or any other cryptocurrency wallet, security is of utmost importance. Ensure that your app follows best security practices, such as validating inputs, protecting private keys, and avoiding vulnerable code patterns.

After all the foregoing steps, you can start using MetaMask as a full-fledged cryptocurrency payment gateway within your application.

Cryptocurrency and Blockchain with Incora

To conclude, we can assume, that regardless of your choice, in any scenario, you will need a dedicated software development team of experts, who are familiar with cryptocurrency and blockchain technologies.

One of the best solutions - is to hire dedicated development team, who has some proven experience in this sphere, just like Incora. For a better illustration, we welcome you to our case studies, where you can learn some details about our recent projects like DeepDao.

What’s your impression after reading this?

Love it!

1

Valuable

1

Exciting

1

Unsatisfied

1

FAQ

Let us address your doubts and clarify key points from the article for better understanding.

What is cryptocurrency payment integration?

Cryptocurrency payment integration is the process of incorporating the ability to accept digital currencies as a payment method within your mobile or web application. It allows users to make transactions using cryptocurrencies like Bitcoin, Ethereum, or other altcoins, instead of traditional fiat currencies.

Why should I consider integrating cryptocurrency payments into my app?

Integrating cryptocurrency payments can offer several benefits, such as:

- Expanding your customer base to cryptocurrency enthusiasts and users.

- Global reach without the need for traditional banking infrastructure.

- Lower transaction fees compared to traditional payment methods.

- Enhanced security and privacy for users' financial transactions.

Which cryptocurrencies can I accept in my app?

The cryptocurrencies you can accept depend on the payment gateway or processor you choose to integrate into your app. Popular options like Bitcoin, Ethereum, Litecoin, and others are commonly supported by most payment processors.

How do I ensure security during cryptocurrency payment transactions?

To ensure security during cryptocurrency payments, follow these best practices:

- Use secure and reputable payment processors with a proven track record.

- Implement two-factor authentication (2FA) for user accounts.

- Encrypt sensitive user data, such as private keys and wallet addresses.

- Regularly update your app and payment processor's software to patch security vulnerabilities.

Can I offer both cryptocurrency and traditional payment options in my app?

Yes, you can provide users with multiple payment options, including both cryptocurrencies and traditional methods like credit cards or PayPal. Offering flexibility in payment methods can improve user satisfaction and increase conversion rates.

What are the fees associated with cryptocurrency payments?

Fees for cryptocurrency payments vary depending on the payment processor and the specific cryptocurrencies involved. Generally, cryptocurrency transactions have lower fees compared to traditional payment methods. However, pay attention to the transaction fees charged by the payment processor you choose.

YOU MAY ALSO LIKE

Let’s talk!

This site uses cookies to improve your user experience. Read our Privacy Policy

Accept

Share this article