How Payroll Automation Reduces Processing Time by Up to 70% for Businesses

November 11, 2025 • 155 Views • 46 min read

Tetiana Stoyko

CTO & Co-Founder

For many businesses, payroll management is a monthly pain point. It’s time-consuming, error-prone, and often stressful.

Especially when spreadsheets, manual data entry, and late approvals are still the norm.

Every delay or miscalculation has a ripple effect across HR, finance, and employee morale.

That’s why payroll automation has become a strategic priority for modern enterprises.

Based on our experience, digitizing and integrating payroll automation processes enables companies to reduce processing time by up to 70%.

It can also help to minimize human errors and ensure compliance with evolving tax and labor regulations.

In this article, we’ll explore how payroll automation systems work, what features define them, and how they deliver measurable business outcomes.

Understanding the Payroll Automation Process

Modern businesses can no longer rely on manual payroll systems.

As teams grow and compliance regulations evolve, even the most organized HR department faces increasing administrative pressure.

That’s where payroll automation comes in.

Simply put, it’s a centralized software solution that handles all payroll-related activities automatically, with minimal human input.

The system typically draws data from multiple sources.

Once the information is synced, the payroll automation process applies company-specific rules to calculate pay accurately and instantly.

An automated payroll system doesn’t just execute payments. It transforms how data moves across departments.

Such solutions ensure that HR, finance, and management teams have access to consistent, real-time information without manual reconciliation.

The outcome: predictable payroll cycles, fewer human errors, and complete transparency across the organization.

Core Features of a Payroll Automation System

Such modern systems are far more than a calculator. It’s a dynamic engine for compliance, transparency, and workforce efficiency.

The most critical features that define a high-performing solution include:

-

Data Synchronization & Integration The system connects directly to your HRIS, accounting tools, and attendance systems. This ensures all data is automatically updated and eliminates double entry or spreadsheet errors.

-

Automated Pay Calculations Whether your business manages hourly wages, commissions, or multi-location payrolls, the system automatically applies calculation formulas, tax brackets, and local compliance rules. This guarantees uniform accuracy across every pay cycle.

-

Built-in Compliance Management Payroll laws change frequently. An automated platform updates itself with the latest tax codes, pension rules, or labor requirements — keeping your payroll compliant without manual research or updates.

-

Employee Self-Service Portal Employees can log in to view payslips, tax documents, or leave balances anytime. This reduces HR’s administrative load and increases transparency for staff.

-

Audit Trails & Reporting Every transaction is logged, timestamped, and traceable. This simplifies audits and improves financial accountability. Reports can be generated on demand — from salary summaries to tax liabilities.

-

Security & Role-Based Access Sensitive payroll data is protected through encryption and access controls, ensuring that only authorized personnel can view or modify financial records.

-

Scalability for Growth As your workforce grows, an automated payroll system scales effortlessly — accommodating new hires, departments, and even international branches without disrupting operations.

These features make automation not just a time-saving tool but a foundation for consistent compliance, employee satisfaction, and strategic decision-making.

How Payroll Automation Integrates with HR & Accounting Tools

The real power of payroll automation lies in its integration.

Most payroll inefficiencies stem from disjointed systems in which HR, finance, and operations use separate tools that don’t communicate effectively.

HR payroll automation solves this by creating a unified ecosystem.

Through APIs and secure data pipelines, it syncs employee details, attendance logs, and expense data in real time.

For instance:

- When HR updates a new hire’s contract in the HRMS, that information is instantly reflected in payroll for the next pay cycle.

- When an employee’s working hours are approved in the time-tracking tool, the system automatically includes them in pay calculations.

- When finance finalizes expense reimbursements, they are automatically included in the next payroll run.

Integration also enables payroll accounting automation. It includes streamlined posting of salary and tax transactions to the general ledger, minimizing reconciliation errors, and keeping financial records up to date.

This end-to-end visibility means fewer manual interventions, reduced dependency on multiple tools, and a single source of truth for all workforce-related data.

Why Understanding the Process Matters

Understanding the payroll automation process is more than just a technical detail. It is a strategic insight.

HR leaders, CFOs, and CTOs who understand how data flows through automation can identify bottlenecks, set more effective KPIs, and make informed technology investments.

When businesses know how to automate payroll effectively, they unlock several high-impact benefits:

- Speed: Payroll cycles compress from days to hours.

- Accuracy: Automated calculations eliminate most human errors.

- Scalability: New hires or locations can be added seamlessly.

- Compliance: The system automatically applies regulatory updates.

In essence, payroll automation transforms an administrative burden into a predictable, measurable, and growth-ready business process, empowering HR and finance teams to focus on strategy rather than repetitive tasks.

Why Businesses Are Moving Toward HR Payroll Automation

In the past, payroll was seen as a back-office routine — necessary but not strategic.

Yet today’s global, hybrid, and compliance-driven environment has made payroll management one of the most complex administrative functions in any organization.

Manually reconciling spreadsheets, juggling tax tables, and reviewing endless email approvals no longer scales.

Businesses need accuracy, agility, and visibility, not paper trails and delays.

By digitizing their payroll operations, companies eliminate friction, reduce costs, and turn what used to be a monthly headache into a continuous, data-driven process that supports growth.

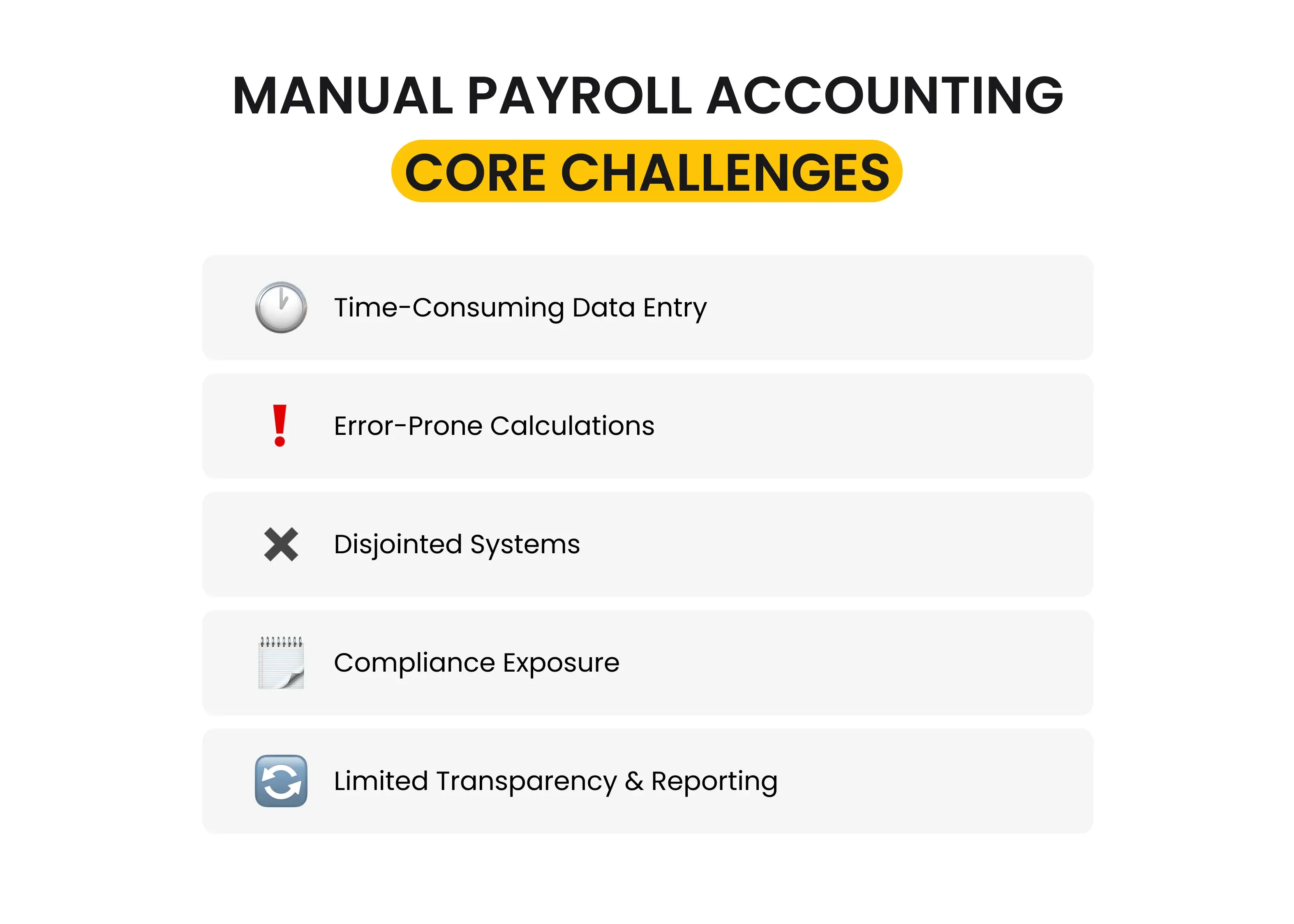

Pain Points in Manual Payroll Accounting

Manual payroll isn’t just tedious — it’s risky.

Every step in a manual workflow introduces potential points of failure, including human error, data duplication, missed tax updates, and compliance oversights.

According to Deloitte, up to 30% of payroll errors stem from inaccurate or incomplete data inputs. And each error costs time, money, and credibility.

Some of the most common challenges in manual payroll accounting include:

-

Time-Consuming Data Entry HR and finance teams spend days gathering timesheets, leave requests, and overtime records. These tasks add no strategic value but consume valuable hours every pay cycle.

-

Error-Prone Calculations Even a slight miscalculation in taxes or deductions can result in underpayment or overpayment, leading to employee dissatisfaction and compliance complications.

-

Disjointed Systems Many companies still operate with disconnected HR and accounting software. Without integration, HR data must be manually exported, adjusted, and reentered for payroll — creating version conflicts and duplication risks.

-

Compliance Exposure Laws and tax rates vary by jurisdiction and change frequently. Keeping up manually is not only time-consuming but dangerous; a single oversight can lead to penalties and audits.

-

Limited Transparency & Reporting Manual systems hinder leaders' ability to access real-time payroll insights. Without dashboards or analytics, organizations can’t identify cost patterns, inefficiencies, or workforce trends.

As businesses grow, these pain points multiply. This is why automating payroll has become less of a luxury and more of a necessity.

Fortunately, there are multiple ways to ensure it. For instance, even AI shift scheduling can help to improve HR and payroll operations.

Payroll Automation Benefits for Growing Teams

The payroll automation benefits are both immediate and long-term.

For growing teams, automation creates order, consistency, and visibility at scale.

Here’s how a well-implemented payroll automation system transforms daily operations:

-

Speed and Efficiency Payroll cycles that once took five days can now be completed in hours. Automated calculations, scheduling, and report generation reduce manual input by up to 70%.

-

Accuracy and Reliability Algorithms handle complex tax brackets, allowances, and bonuses with mathematical precision, eliminating the risk of human error in pay or deductions.

-

Scalability Across Locations Whether you’re managing a local team of 20 or a distributed workforce across five countries, automation scales effortlessly, applying local compliance rules while maintaining unified oversight.

-

Improved Employee Satisfaction Timely, error-free payroll builds trust. When employees can access their payslips, bonuses, or tax forms anytime through self-service dashboards, it creates transparency and reduces HR queries.

-

Actionable Data and Analytics Automation turns payroll data into a business asset. Finance teams can visualize salary trends, cost allocations, or overtime patterns, helping executives plan more effectively and optimize workforce spending.

-

Seamless Integration with HR and Finance Automated systems sync directly with HRIS, ERP, and accounting tools, keeping employee information consistent across departments and reducing cross-team friction.

The benefits of an automated payroll system enable HR and finance leaders to focus on people management, talent strategy, and business growth, rather than routine administration.

Compliance and Accuracy Through Automation of Payroll

In today’s regulatory environment, payroll compliance is a moving target.

Governments introduce new wage thresholds, social contribution rates, and data privacy laws every year.

Staying compliant manually requires constant research and manual reconfiguration — a process that is both fragile and unsustainable.

Automation of payroll solves this by embedding compliance logic directly into the system.

For instance:

- Tax codes, contribution rates, and benefit rules are automatically updated by jurisdiction.

- The system validates data before each payroll run, flagging anomalies such as missing records or duplicate entries.

- Automated reports ensure accurate filings and reduce the administrative burden during audits.

This proactive compliance approach is invaluable for businesses operating across multiple regions or industries.

It guarantees accuracy while protecting organizations from costly penalties or employee disputes.

Additionally, payroll accounting automation ensures every transaction aligns with financial reporting standards.

Once payroll is processed, entries are automatically posted to the general ledger, maintaining transparent, audit-ready books without additional manual reconciliation.

The Strategic Value of HR Payroll Automation

Beyond time and cost savings, the move toward HR payroll automation represents a larger cultural shift: from reactive administration to strategic enablement.

Modern HR teams are no longer just record keepers; they are architects of employee experience and organizational growth.

Automating payroll allows them to reclaim time and resources to focus on initiatives that truly matter, such as engagement, retention, and workforce development.

Finance leaders benefit too. With integrated, real-time data, they can forecast payroll costs, model headcount growth, and optimize cash flow with greater accuracy.

Ultimately, payroll automation benefits extend far beyond efficiency — they build a foundation of trust, transparency, and scalability across the enterprise.

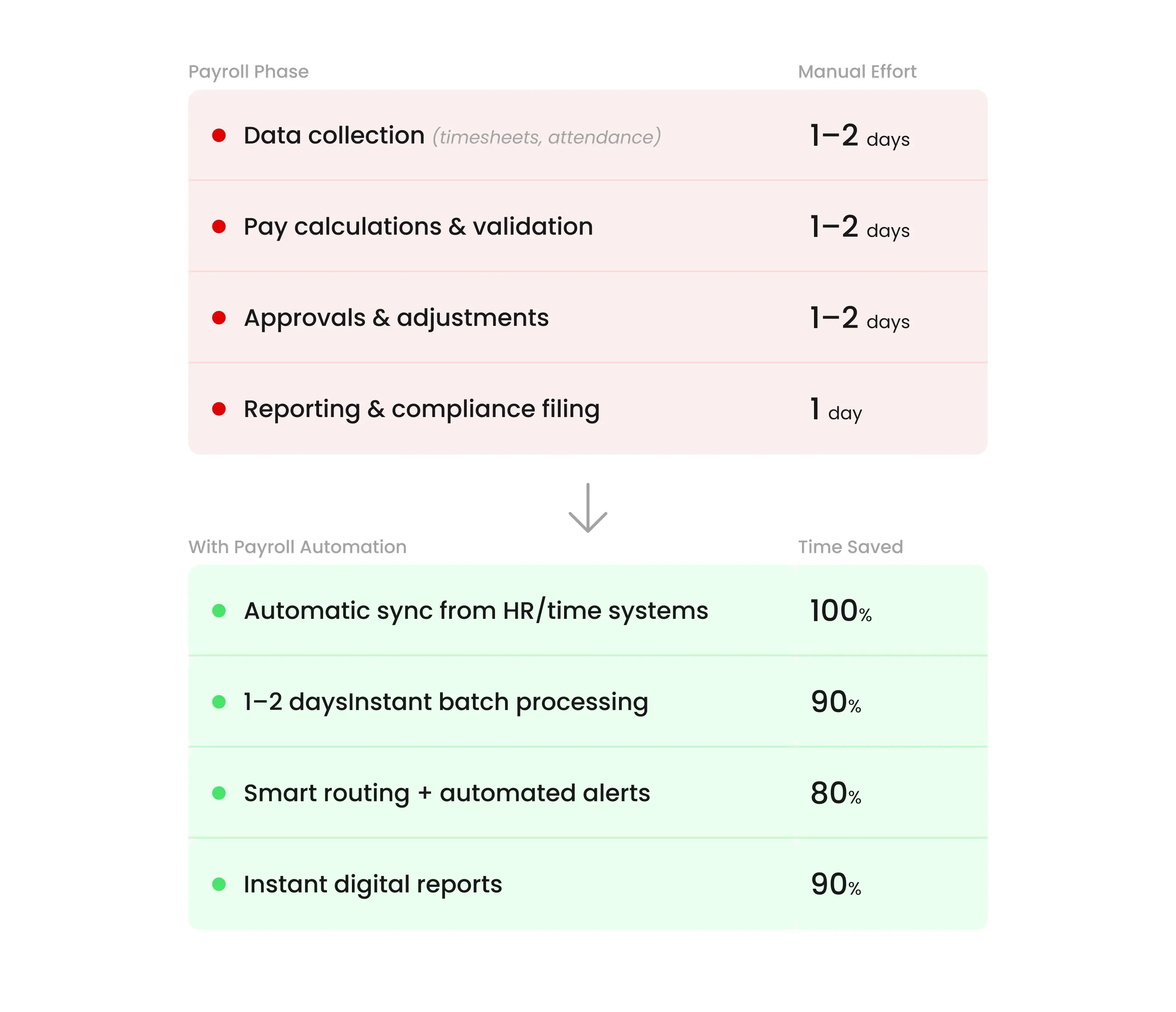

How Payroll Automation Reduces Processing Time by 70%

The actual value of payroll automation lies not just in precision, but in time compression.

Organizations that once needed an entire week to finalize payroll now close their cycles in a day or less.

Based on our experience, companies that transition to automated payroll solutions report an average 60–70% reduction in processing time and a 90% decrease in manual interventions.

This improvement doesn’t come from simply digitizing spreadsheets — it comes from rethinking how payroll data flows, approvals are handled, and compliance is managed end-to-end.

Let’s explore how automation achieves these time savings in practice.

Batch Calculations, Scheduling & Tax Filing

In manual payroll environments, each pay period starts with repetitive calculations for base pay, overtime, commissions, benefits, and deductions, which are handled individually or via static templates.

With a payroll automation system, these tasks are replaced by batch processing.

Once employee data is synchronized, the system runs calculations for hundreds or even thousands of employees simultaneously.

It automatically applies tax rules, deductions, and benefits logic in real time.

Automated scheduling features take it even further. Payroll runs, payslip generation, and tax filings can be pre-set to execute on specific days.

This ensures consistency and eliminates human delays — no more waiting for approvals or rechecking data at month-end.

For example:

- HR schedules payroll to run on the last Thursday of every month.

- The system calculates all wages, generates payslips, and automatically triggers tax filings.

- HR and finance simply review exceptions (if any), approve, and release payments.

This structured automation transforms multi-day workflows into streamlined, hour-long operations — all while maintaining compliance and audit readiness.

Reduced Manual Intervention and Approval Loops

One of the main bottlenecks in traditional payroll processing is the approval chain.

Every minor correction or exception requires multiple sign-offs from HR, finance, and management, often via email or paper forms.

This introduces waiting time, confusion, and version errors.

Payroll automation redesigns this flow completely.

Smart workflows automatically route exceptions for review, while routine payments pass through pre-approved logic.

The system also sends automated notifications to stakeholders, ensuring no step is missed or delayed.

Here’s how automation accelerates the approval cycle:

-

Automatic Validation: The system flags anomalies (like missing hours or inconsistent tax IDs) before submission.

-

Predefined Rules: Common scenarios, like standard overtime or bonuses, are pre-approved and require no manual review.

-

Real-Time Alerts: Approvers receive instant notifications for exceptions only, not every record.

-

Digital Sign-Off: Managers can approve payroll runs within the system — no emails, no back-and-forth.

This level of process intelligence enables HR to focus on strategic tasks instead of chasing signatures.

The result? Payroll teams reclaim entire workdays each month.

Examples of Time Savings with Payroll Automation System

To illustrate how powerful automation can be, consider a few real-world use cases:

Example 1: Mid-Sized Tech Company (300 employees)

-

Before automation: The Payroll team spent five full days collecting timesheets, verifying data, and preparing reports.

-

After implementation of a payroll automation system, the same process takes 1.5 days — a 70% reduction in cycle time and a near-zero error rate.

Example 2: Manufacturing Business with Multi-Shift Workers

- Manual calculation of overtime and shift differentials once took 3–4 days.

Automation now imports time-tracking data directly, processes pay by shift category, and automatically applies tax codes. Payroll completion: under 24 hours.

Example 3: Multi-Country Retail Brand

-

Previously, global payroll consolidation required cross-departmental coordination among HR teams in different regions.

-

By automating payroll, the organization standardized pay structures and compliance rules across countries, cutting processing time in each region by over 60% while maintaining full local compliance.

These examples prove a consistent pattern: time savings scale with workforce size. The larger and more distributed the team, the higher the ROI of automation.

Where the 70% Time Savings Actually Come From

To understand how the 70% reduction is achieved, it’s helpful to see where automation makes the most significant impact:

Automation compresses every phase of the payroll automation process, from data intake to final reporting, turning week-long efforts into structured, rule-driven workflows.

Hidden Time Savings Through Integration

Time savings don’t stop at payroll itself. When connected to HR and accounting systems, payroll accounting automation eliminates hours spent reconciling financial data.

Each payroll run automatically posts journal entries into your ERP or accounting platform. That means fewer manual exports, reconciliations, and double-checks.

Additionally, employees gain access to self-service portals, reducing HR’s time spent on payslip requests, tax clarifications, and benefit queries by up to 40%.

In short, automation doesn’t just make payroll faster — it makes every surrounding process faster too.

Why the 70% Metric Matters to Executives

From a leadership perspective, the 70% reduction in payroll processing time isn’t just about saving hours — it’s about operational agility and scalability.

Faster payroll cycles mean:

- HR teams spend less time on administration and more on workforce development.

- Finance teams get faster, cleaner data for cash flow forecasting.

- Leadership gains visibility into real-time labor costs, enabling more intelligent decisions.

- Employees get paid on time, every time — which strengthens trust and engagement.

In essence, payroll automation transforms a recurring bottleneck into a strategic growth enabler.

When time is reclaimed, organizations can scale without proportionally increasing HR and finance headcount.

How to Automate Payroll in Your Company

Adopting payroll automation is no longer a luxury for modern organizations. Successfully automating payroll requires more than simply purchasing software; it demands alignment among HR, finance, and IT departments.

Whether you’re a mid-sized enterprise looking to streamline manual operations or a global company scaling across markets, the journey toward automation should follow a structured roadmap.

Below is a practical, executive-level guide to automating payroll efficiently, sustainably, and with measurable ROI.

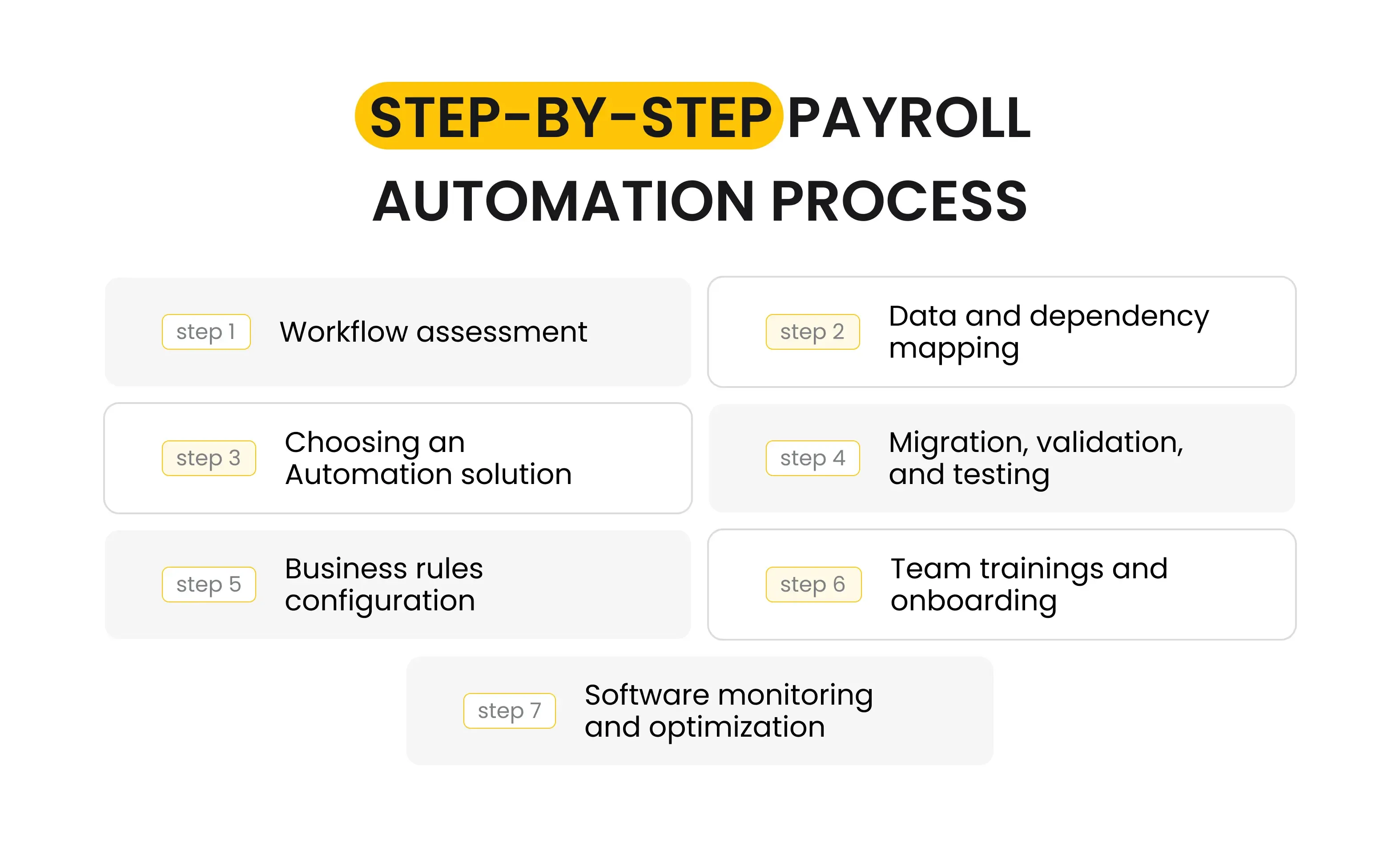

Step-by-Step Payroll Automation Process

The payroll automation process typically unfolds in several key phases.

Each stage plays a vital role in ensuring your system is accurate, compliant, and smoothly integrated across the organization.

The payroll automation process includes the following stages:

- Workflow assessment

- Data and dependency mapping

- Choosing an Automation solution

- Migration, validation, and testing

- Business rules configuration

- Team trainings and onboarding

- Software monitoring and optimization

1. Assess Current Payroll Workflows

Start by identifying your pain points. Where do delays or errors occur most often?

Look at:

- Manual data entry bottlenecks

- Compliance and tax filing challenges

- Approval or reporting inefficiencies

Understanding these areas will help you set clear automation goals — such as reducing processing time, improving compliance accuracy, or centralizing data flow.

2. Map Your Data and Dependencies

A successful payroll automation depends on clean, well-structured data.

Map all your data sources, such as HR records, time-tracking systems, bonus structures, and benefits platforms.

Identify what needs to be synchronized, standardized, or cleaned before migration.

Poor data hygiene is one of the most common reasons automation projects stall.

Start with quality, and your automation will deliver faster and more reliable outcomes.

3. Choose the Right Payroll Automation System

Selecting the right payroll automation system is a critical decision.

It should fit your business model, compliance landscape, and integration needs.

When evaluating options, prioritize systems that offer:

- Robust integrations with your HRIS, ERP, and accounting tools

- Cloud security and strong encryption

- Multi-country compliance support for global teams

- Scalable architecture that grows with your business

- Customizable automation workflows for unique pay structures

A good solution doesn’t just automate — it adapts to your organization’s specific logic and culture.

4. Migrate, Validate, and Test

Data migration should happen in phases.

Begin with one department or pay group before scaling organization-wide.

Test results at every stage, comparing automated outputs with historical data to confirm accuracy.

This validation step is essential to ensure your payroll accounting automation aligns perfectly with your existing financial controls and reporting standards.

5. Configure Business Rules & Compliance Logic

Next, tailor the payroll automation system to your policies and regulations. Set up:

- Pay frequencies and schedules

- Tax codes and jurisdictional rules

- Benefits, bonuses, and deductions

- Approval hierarchies and escalation logic

Many platforms come with built-in templates for these elements, but customization ensures your automation reflects the exact needs of your workforce and legal environment.

6. Train and Onboard Your Teams

Even the most advanced technology needs people who trust and understand it.

Develop a clear HR payroll automation onboarding plan that covers:

- Live demos and training sessions

- User manuals and knowledge bases

- “Champion users” within each department who can guide peers

This investment pays off through faster adoption, higher confidence, and fewer post-launch errors.

7. Monitor, Optimize, and Evolve

Once live, continuously monitor the system’s performance.

Use real-time dashboards to track metrics like cycle duration, error rate, and employee satisfaction.

Refine automation rules as regulations or company policies evolve.

A good payroll automation process isn’t static — it’s a continuous improvement loop that grows smarter over time.

Choosing the Right Payroll Automation System

Selecting your software partner is a decision that can define payroll efficiency for years to come.

To choose wisely, align IT, HR, and finance leadership from the start.

Each department will bring different priorities to the table:

- HR Leaders want accuracy, transparency, and a great employee experience.

- Finance teams require compliance, precise reporting, and seamless integration with accounting systems.

- IT Departments focus on scalability, API connectivity, and cybersecurity.

When evaluating vendors, request demos that showcase real-world workflows, not just feature lists.

Ask questions like:

- Can the platform handle multiple entities or currencies?

- How does it update tax tables or compliance rules?

- What are its uptime guarantees and data backup policies?

A strategic vendor will also help you assess how to automate payroll incrementally — avoiding disruption while delivering quick wins.

Onboarding Your HR and Finance Teams

Successful implementation depends as much on people as it does on technology.

Even the best-designed payroll automation system will underperform if teams cling to manual habits.

Here’s how to make onboarding seamless:

- Communicate early. Explain why automation is happening and how it benefits both HR and employees.

- Train hands-on. Use test environments where staff can safely explore features.

- Show measurable wins. Highlight how time spent on payroll has dropped or how accuracy improved — this reinforces adoption.

- Gather feedback. Employees often uncover edge cases that help refine the process.

HR payroll automation is a cultural shift as much as a technological one.

When staff understand its value, they become champions of efficiency — not resistors of change.

Building a Scalable Payroll Foundation

Once automation is up and running, it creates the foundation for broader digital transformation across your HR and finance ecosystem.

For example:

- Payroll accounting automation ensures transactions post directly to your ERP — improving cash flow visibility.

- Integration with HR analytics lets executives correlate payroll trends with productivity or retention metrics.

- Cloud-based architecture allows remote HR teams to operate securely from anywhere in the world.

By aligning people, processes, and technology, companies move from reactive payroll management to proactive business intelligence.

Why Strategy Matters More Than Speed

Many businesses rush into automation expecting instant results, but successful adoption depends on deliberate execution.

A thoughtful, data-driven rollout ensures every element — from employee data integrity to compliance mapping — supports sustainable efficiency.

In other words, payroll automation isn’t just about cutting time; it’s about building a predictable, scalable, and audit-ready system that grows with your company.

Real Business Outcomes of Payroll Accounting Automation

Real business outcomes of payroll accounting automation include:

- Scalability and remote accessibility

- Error reduction and faster payroll cycles

- Improved reporting and audit readiness

Scalability for Multi-Location or Remote Teams

Distributed workforces create payroll complexity.

With payroll accounting automation, global teams can operate under unified payroll policies while maintaining local compliance.

This adaptability is key to scaling across countries or remote-first structures.

Error Reduction and Faster Payroll Cycles

Automation eliminates calculation errors and redundant reviews.

HR professionals can reallocate time from manual reconciliation to strategic initiatives, such as workforce analytics and retention strategies.

The result? Faster, more accurate payroll runs that build trust across your organization.

Improved Reporting and Audit Readiness

With built-in tracking and version control, every payroll transaction becomes auditable.

Reports are generated instantly for tax authorities, auditors, or internal management — improving visibility and accountability across all departments.

Challenges in Automating Payroll — And How to Overcome Them

While payroll automation delivers undeniable efficiency and accuracy, the transition isn’t without challenges.

From legacy data migration to system integration and change management, businesses often underestimate the planning and coordination required to get it right.

However, with the right strategy, these obstacles cannot only be overcome but also turned into opportunities to strengthen your company’s HR and finance infrastructure.

Below are the most common challenges organizations face when adopting HR payroll automation, along with proven ways to address them:

- Data migration and system integration

- Security, accessibility, and compliance

- Change management

- Customization and scalability

- Maintaining Accuracy During Transition

- Cultural and Organizational Alignment

Data Migration & System Integration

One of the biggest hurdles in automating payroll is migrating data from legacy systems, spreadsheets, or local databases into the new environment.

Payroll data is complex — it involves years of employee records, tax filings, benefits, deductions, and compliance history.

Any inconsistency or missing information can disrupt the accuracy of automation from day one.

The Challenge:

- Incomplete or duplicated employee records

- Historical data stored in incompatible formats

- Integration issues with HR, accounting, or time-tracking systems

- Lack of centralized data ownership across departments

How to Overcome It:

- Start with data cleansing. Audit all existing payroll and HR data before migration. Remove outdated records, correct mismatched fields, and fill in missing details.

- Run pilot migrations. Start by testing one department or pay group to ensure accuracy before scaling.

- Use middleware for integration. API-based connectors can seamlessly synchronize your new payroll automation system with HRMS, ERP, and accounting tools.

- Define data governance roles. Assign clear responsibilities for data validation and maintenance across HR and finance teams.

When migration is handled strategically, automation starts on a solid, trusted foundation.

Security, Access Control, and Compliance Risks

Payroll data is among the most sensitive information a company manages — containing salaries, bank details, social security numbers, and tax identifiers.

As payroll systems move to the cloud, concerns around cybersecurity, data privacy, and regulatory compliance become top priorities.

The Challenge:

- Unauthorized data access or accidental exposure

- Inadequate encryption and storage policies

- Misalignment with regional regulations (GDPR, HIPAA, SOC 2)

- Lack of user-specific permissions or audit trails

How to Overcome It:

- Adopt role-based access controls (RBAC). Only authorized users should view or modify payroll data — with layered permission levels for HR, finance, and leadership.

- Ensure encryption in transit and at rest. All payroll and banking data must be encrypted using modern protocols (e.g., AES-256).

- Work with compliant vendors. Choose a payroll automation system certified for ISO 27001, SOC 2, and GDPR compliance.

- Implement regular security audits. Schedule quarterly vulnerability scans and compliance checks.

- Educate staff. Security isn’t just technical — it’s behavioral. Regular training on phishing, password hygiene, and data confidentiality is essential.

Secure automation is the backbone of trust in digital payroll transformation.

Change Management Within HR Teams

Even when the technology is perfect, people can resist change.

For many HR professionals, payroll processes have been built around years of manual control and familiar tools like Excel.

Transitioning to full payroll automation requires a mindset shift as much as a system upgrade.

The Challenge:

- Resistance to new tools and workflows

- Fear of job redundancy or loss of control

- Lack of digital literacy or confidence in automation

- Insufficient training during rollout

How to Overcome It:

- Communicate early and transparently. Explain the “why” behind automation — efficiency, accuracy, and scalability — rather than just the “what.”

- Involve HR early in planning. Incorporate HR team members into the vendor evaluation and configuration process. This fosters ownership.

- Provide ongoing training. Hands-on workshops, simulations, and onboarding materials help staff become fluent in using new systems.

- Highlight success metrics. Show measurable improvements — reduced cycle time, fewer errors, or easier reporting — to build trust and enthusiasm.

- Position automation as empowerment. Emphasize that automation frees HR from administrative burdens, allowing them to focus on strategic people management.

By turning HR into advocates rather than skeptics, adoption accelerates, and the long-term success of hr payroll automation is guaranteed.

Customization and Scalability Challenges

No two businesses run payroll the same way.

Different pay frequencies, bonus structures, local tax rules, and reporting requirements make off-the-shelf solutions tricky to implement without adjustments.

The Challenge:

- Inflexible automation workflows that don’t reflect company-specific logic

- Limited scalability for multi-country operations

- Delays during configuration or testing due to complex pay models

How to Overcome It:

- Select customizable platforms. Ensure the system allows rule-based configurations for pay cycles, bonuses, and region-specific compliance.

- Use modular deployment. Implement automation in phases, starting with core payroll and expanding to benefits, bonuses, or compliance modules.

- Collaborate closely with your vendor. A good provider will help tailor workflows and test complex cases (e.g., expatriate pay, commission-based teams).

- Plan for future growth. Choose software that scales with your headcount and geographic expansion — without requiring new implementations.

Scalability ensures that today’s automation success remains tomorrow’s advantage.

Maintaining Accuracy During Transition

Even the best systems can fail if not calibrated correctly during the switch.

Transition phases, in which some processes are automated while others remain manual, are especially prone to errors.

The Challenge:

- Data mismatches between old and new systems

- Duplicate calculations or missed payments during hybrid periods

- Overlapping responsibilities between HR and IT

How to Overcome It:

- Run parallel payroll cycles. For the first few months, execute both automated and manual runs to compare outputs.

- Assign clear ownership. Define which teams are responsible for each step in the transition period to avoid overlap.

- Use exception reports. These highlight discrepancies in real time, allowing quick corrections before payment.

- Schedule post-implementation audits. Review the first three months of automated cycles to confirm sustained accuracy.

This careful oversight builds confidence and ensures a smooth long-term transition to full automation.

Cultural and Organizational Alignment

Automation introduces efficiency — but it also shifts accountability.

Payroll becomes faster, data becomes visible across departments, and processes become traceable.

This transparency can expose previously hidden inefficiencies.

The Challenge:

- Misalignment between HR, finance, and IT objectives

- Different expectations for automation speed and outcomes

- Lack of shared KPIs for success measurement

How to Overcome It:

- Create a cross-functional payroll task force. Involve stakeholders from HR, finance, and IT to align on goals, metrics, and timelines.

- Define joint KPIs. Examples: reduced processing time, improved error rate, or increased compliance accuracy.

- Review outcomes quarterly. Keep alignment between departments as the automation matures.

When all departments share ownership of the automation journey, it becomes an enterprise-wide success — not just an HR upgrade.

Key Takeaway: Challenges Are Part of the ROI

Every transformation involves friction.

The good news?

Each challenge in automating payroll can be mitigated with a proactive strategy, transparent governance, and employee involvement.

The payoff is lasting — a system that saves time, increases accuracy, ensures compliance, and supports growth.

With proper preparation and a suitable partner, payroll automation benefits far outweigh the temporary complexities of implementation.

Reduce Payroll Processing Time with Incora

In today’s fast-moving business world, time is money — and payroll is no exception.

The benefits of an automated payroll system go far beyond time savings: they empower HR, finance, and leadership with real-time insights, accuracy, and compliance readiness.

By implementing a robust payroll automation system, companies can achieve faster payroll cycles, improved employee satisfaction, and operational resilience.

Now is the time to transition from manual effort to intelligent automation.

See how payroll automation transforms not just your payroll, but your entire business efficiency. Contact us, and we will find the best-fitting solution for you!

What’s your impression after reading this?

Love it!

10

Valuable

7

Exciting

12

Unsatisfied

2

FAQ

Let us address your doubts and clarify key points from the article for better understanding.

What is payroll automation?

Payroll automation is a centralized software solution that handles all payroll-related activities automatically with minimal human input, drawing data from multiple sources and applying company-specific rules to calculate pay accurately and instantly.

How much time can payroll automation save?

Businesses typically reduce payroll processing time by 60-70%, compressing cycles from 5 days to under 1.5 days, while eliminating up to 90% of manual interventions.

What are the main benefits of payroll automation?

Key benefits include eliminating manual calculation errors, ensuring automatic compliance with tax and labor regulations, reducing HR administrative queries by 40%, providing real-time labor cost visibility, and enabling seamless scalability across locations and employee counts.

What features should a payroll automation system have?

Essential features include HRIS and accounting system integrations, automated tax and compliance updates, employee self-service portals for payslips and documents, audit trails with on-demand reporting, role-based security access, and scalable architecture for growth.

How does payroll automation ensure compliance?

The system automatically updates with the latest tax codes, pension rules, and labor requirements across jurisdictions, validates data before each payroll run, and flags anomalies—eliminating the need for manual research and reducing compliance risk.

What's required to implement payroll automation?

Implementation involves assessing current workflows to identify bottlenecks, mapping and cleaning data sources, selecting a system with necessary integrations, migrating data, configuring workflows, and training teams to use the new platform.

Does payroll automation work for multi-country operations?

Yes, modern payroll automation systems support multi-country compliance, automatically applying local tax rules and labor regulations for each jurisdiction while maintaining centralized management and reporting.

How does automation improve employee experience?

Self-service portals give employees 24/7 access to payslips, tax documents, and leave balances without HR involvement, increasing transparency and reducing administrative requests by up to 40%.

YOU MAY ALSO LIKE

Construction

AI Compliance Agent for Construction: Automating HSE and Regulatory Compliance

HR Automation: How to Improve Employee Management and Tracking Systems With the Use of AI

Construction

AI Shift Scheduling for Construction: Is This the Future of HR and Payroll?

Construction

From 10 to 2 Hours: How Conversational AI Agents Transform Construction Report Generation

Construction

How AI Negotiation Agents Improve Construction Procurement [And Why Do You Need It]

Let’s talk!

This site uses cookies to improve your user experience. Read our Privacy Policy

Accept

Share this article