Construction

AI Anomaly Detection in Different Industries: A Practical Guide for Business Leaders

October 07, 2025 • 109 Views • 22 min read

Tetiana Stoyko

CTO & Co-Founder

The modern world is data-driven. Countless businesses and whole industries rely on software solutions and the quality of data they operate on daily. However, apart from ensuring the seamless work of multiple management and operational systems, data plays a crucial role in cybersecurity and the financial field.

Today, we would like to discuss AI anomaly detection and its benefits to businesses, regardless of the industry they represent. However, before considering the main reasons for integrating artificial intelligence for data control and management, we have to learn more about the primary services and features used under the hood of these solutions.

What Is an Anomaly Detection Agent?

Traditionally, anomaly detection is a process of monitoring and auditing data, which involves flagging unusual transactions, requests, or other odd deviations. The details of anomaly detection vary depending on the type of data being reviewed or the industry-specific requirements.

On top of that, this audit differs due to other factors, such as:

- The scale of organization (SMBs, Enterprises, etc.)

- Budget limitations (expenses on anomaly detection applications, or other tools)

- Preferred approaches, algorithms, and statistical models

For example, small companies often cannot afford to hire full-time specialists responsible for continuous real-time anomaly detection. Therefore, such businesses must conduct retrospective analyses, which are performed periodically and involve a manual review of the data.

At the same time, middle to large corporations can afford to employ more staff and utilize specialized tools for semi-autonomous and continuous tracking.

However, such a distinction was common in the past. Nowadays, AI anomaly detection solutions can easily align the working conditions. Thanks to the overall affordability of artificial intelligence models and high-level customization, it is possible to use even the simplest AI solution for automated anomaly detection.

All of these software solutions share a set of specific features, highly useful for anomaly detection, including:

- Natural Language Processing (NLP) enables them to comprehend various types of text and human speech, facilitating the examination and classification of different languages and symbols. As a result, AI-based data processing can easily analyze texts, spreadsheets, and various documents for gathering information.

- Pattern-seeking is an essential feature for any AI model, enabling it to learn and train by identifying correlations, similarities, and causal relationships between different events. Moreover, this feature is vital for anomaly detection, enabling virtual assistants to distinguish between “normal” and “strange” operations, flagging them much faster and accurately.

- Continuous work and improvement. Unlike humans, artificial intelligence works without interruptions and is available 24/7 as long as it has power and data access. Additionally, almost any modern model has a machine learning capacity, enabling it to train and self-improve using historical data continually.

However, there is also a difference between a basic AI model and agentic artificial intelligence. While traditional AI is reactive, i.e., it works on demand and requires human requests, an agentic solution is more autonomous.

Simply put, traditional models are excellent for accelerating the audit process: you can feed them documentation or other data you want to check, and with some appropriate prompting, they will flag all suspicious activities or other anomalies in shared data.

However, suppose you are looking for a full-fledged and autonomous assistant that can work continuously and is capable of tracking data in real-time. In that case, you need an agentic anomaly AI. These systems require more expertise and some software development, but involve minimal or no human interaction.

For instance, you can set up such agents to simply flag and notify a specialist when an anomaly is detected. Thus, your employees can work on more complex, private, or urgent tasks and make decisions only when needed.

Basically, an anomaly detection agent is an AI-driven system designed to identify unusual patterns, errors, or suspicious activities in real-time. They can also be customized and applied to different processes or fields. For example, a similar agent might flag a vendor invoice that doesn’t align with historical payment trends or detect an employee expense that violates company policy.

Unlike manual review processes, automated anomaly detection agents operate continuously and in real-time, providing finance teams with a proactive way to safeguard assets and enhance decision-making.

How Anomaly Detection Works?

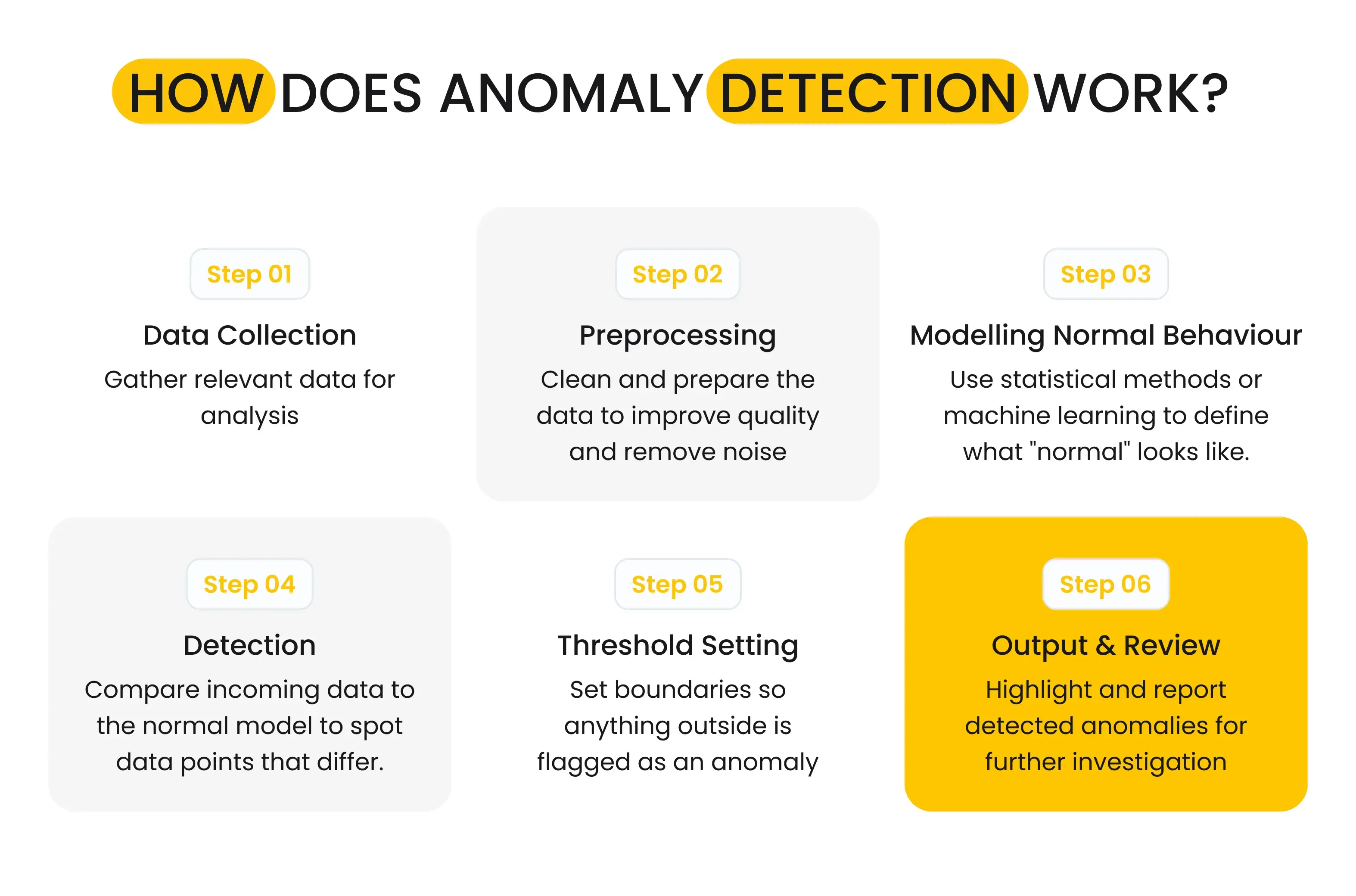

Anomaly detection relies on both traditional statistical approaches and modern AI-driven methods. The choice depends on the complexity of the data and the risks being monitored.

Statistical Methods

Most companies prioritize statistical methods for automated anomaly detection. For small projects or operations, a simple Excel would be enough. Spreadsheets and other similar simple software solutions offer enough flexibility and calculation capacity to apply the most common techniques for faster analysis.

For instance, one well-known method is Benford’s Law, which shows how often certain digits should appear at the start of financial numbers. If expenses don’t follow this pattern, it may signal fraud. Other standard methods, such as z-scores, variance checks, and moving averages, can highlight unusual values in structured data, including expense reports or account balances.

In brief, statistical methods are the most common and relatively straightforward solutions for such tasks. There are also multiple free anomaly detection applications, based on different techniques and statistical approaches.

However, the main challenges of the statistical anomaly approach include:

- Limited adaptability: They cannot adapt to new conditions, requiring the involvement of specialists for manual rule-tuning.

- Primarily manual: Despite the variety of software tools, statistical methods still highly rely on manual work, demanding more effort than alternatives.

- Lack of scalability: This approach struggles with multi-variable datasets, such as vendor type, region, and payment channel, combined.

- Primarily number-focused: Additionally, most statistical methods are focused on dealing with numbers, which limits their usability for other tasks and processes that rely more on terms or words. Enabling the analysis of words requires additional steps and techniques, making it more complex to implement.

- Retrospective nature: Finally, using Spreadsheets for anomaly analysis is outdated; it suggests learning about abnormal activities after they have already occurred.

To address most of these drawbacks, many third-party Software-as-a-Service vendors offer their services, which commonly include process automation and alerts or notifications. Yet, such services commonly streamline and fine-tune statistics or anomaly detection AI algorithms, built into the offered SaaS solutions.

Machine Learning Methods

Unlike traditional statistical methods, machine learning algorithms suggest more flexibility and personalization. They can adapt to changing conditions and analyze more complex relationships in data. Additionally, AI anomaly detection can handle various types and sources of data out of the box.

Such flexibility significantly scales the use cases for anomaly detection, providing specialists with more advanced toolsets and other solutions for efficient work. Among such advanced techniques, there are:

- AutoEncoders that compress and reconstruct data; significant reconstruction errors often signal anomalies.

- Clustering algorithms (such as k-means or DBSCAN) group transactions into clusters and identify data points that don’t fit.

- Time-series models detect irregular trends in sequential data, such as monthly spend or daily transaction volumes.

These approaches are beneficial for high-dimensional financial datasets where patterns are non-linear and subtle. Still, these are not the only ML-driven solutions for anomaly detection. For instance, the strong pattern-seeking capabilities of artificial intelligence models can reveal more uncommon and unexpected correlations within the datasets.

Additionally, AI anomaly detection models can be integrated directly into your management or other business systems. They are easier to control and organize, scale, or adjust to new specific needs or challenges.

For example, custom AI fraud detection solutions can automatically notify your team about suspicious or hazardous activities in real-time, significantly increasing the efficiency and impact of such systems in your business operations, unlocking powerful options like immediate fraud prevention or higher risk assessment.

Key Industry-Specific Challenges Anomaly Detection Solves

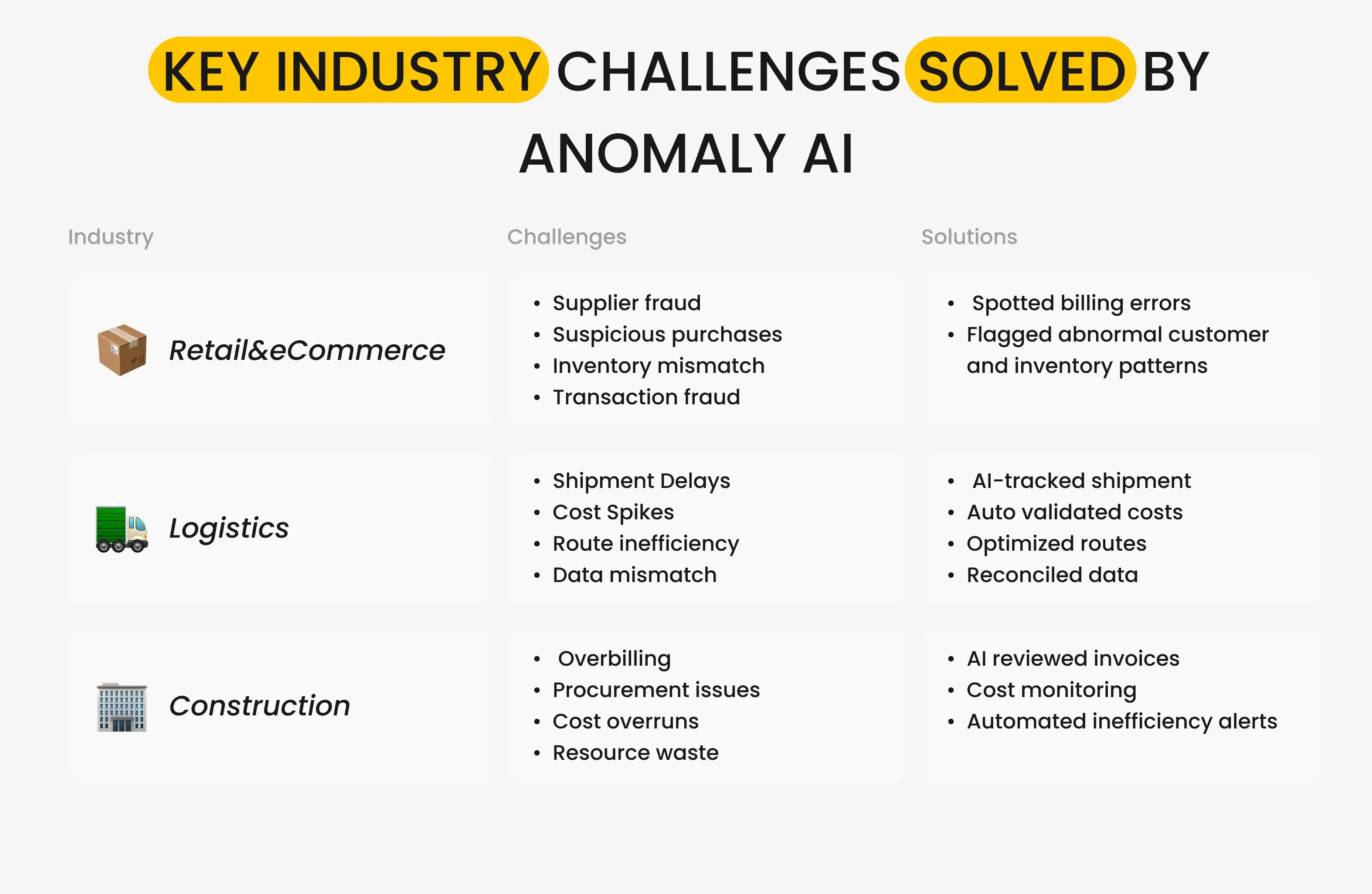

Different industries face unique operational and cost control challenges that go beyond financial reporting errors. Anomalies are commonly found in fields that work with numerous vendors, suppliers, and transactions.

To be more specific, anomalies often signal fraud, inefficiencies, or hidden risks in retail & eCommerce, logistics, and construction areas. It can directly impact profitability, customer trust, and project success. By deploying AI-driven anomaly detection, business owners can gain real-time visibility into these risks and act before they escalate.

For a clearer illustration, let’s consider some more practical examples of how AI anomaly detection can benefit these niches and address their core challenges.

Retail and eCommerce Anomaly Management

As mentioned before, retail and eCommerce deal with numerous third parties, ranging from customers to suppliers, promoters, and other stakeholders. Each user category has its own specific metrics to manage. Within this volume, anomalies often emerge as:

- Supplier fraud, commonly accompanied by inflated invoices, duplicate billing, or unauthorized charges.

- Unusual purchasing behavior can be identified through sudden spikes in returns, coupon abuse, or fake refund requests.

- Inventory irregularities include mismatched stock counts between warehouses and POS systems.

- Transaction anomalies typically indicate credit card fraud, bot-driven purchases, or suspicious discounts applied during checkout.

These anomalies matter because they not only erode margins but also undermine customer trust and strain supplier relationships. Not to mention their impact on multiple operations within the chain.

To solve and identify such threats, retail agencies and eCommerce platforms use various software solutions that help identify and prevent the most common issues related to the foregoing list. However, these solutions are not always as efficient as they are supposed to be. How does AI anomaly detection help?

- It can compare supplier charges against historical patterns and contract terms to prevent overbilling and validate invoices.

- Thanks to advanced integration capabilities, anomaly AI can be synchronized with POS transaction monitoring processes. Using this data, it can identify abnormal spikes in returns, discounts, or refund claims.

- Apart from that, using customer data and behaviour patterns, such systems can flag unusual purchase activity and notify specialists for a more detailed approach and consideration.

- Finally, AI systems can track inventory operations, detecting mismatches between sales data and warehouse records, and reducing stock leakage.

Long story short, automated anomaly detection in retail and eCoomerce acts like a digital auditor. It continuously scans supplier invoices, POS logs, and order histories to identify irregularities before they escalate into costly disputes.

Anomaly AI in Logistics

Just like eCommerce, Logistics operations are highly sensitive to timing, cost accuracy, and delivery consistency. However, in addition to affecting transactions or other similar aspects, logistics anomalies can be identified in freight routing, fuel consumption, delivery time management, or data discrepancies.

The most common anomalies include:

- Shipment delays or losses with irregular transit times, missing cargo, or unexpected rerouting.

- Freight cost anomalies, when managers face unexpected spikes in carrier charges or hidden surcharges.

- Fuel and route inefficiencies, usually related to unusual mileage, fuel usage, or driver behavior patterns.

- Data discrepancies occur due to mismatches in shipment records between carriers, warehouses, and ERP systems.

These anomalies can create ripple effects across the supply chain, resulting in dissatisfied customers, strained SLAs, higher operational costs, and reputational damage.

Fortunately, using AI anomaly detection in logistics helps to cover these drawbacks by:

- Real-time shipment tracking

- Freight billing validation

- Route optimization monitoring

- System reconciliation

By applying anomaly detection, logistics companies gain early warning signals. It allows them to prevent issues in early stages or fix them ASAP, which enhances customer satisfaction, minimizes cost leakages, and bolsters trust in supply chain reliability.

AI Anomaly Detection for Construction

Lastly, the construction and real estate industries face similar challenges. However, in addition to the foregoing issues, they also face tighter budgets and timelines, involving multiple subcontractors and vendors.

Problems and mistakes within the chain can cause a cascading effect on the entire project, stopping ongoing work and pushing back planned deadlines. Therefore, early anomaly detection is a vital element for any construction business. Among anomalies, worth extra attention are:

- Subcontractor overbilling: inflated labor hours, duplicate charges, or misclassified tasks.

- Procurement anomalies: material invoices that don’t align with market prices or project usage.

- Project cost overruns: hidden deviations from planned budgets that surface too late.

- Resource inefficiencies: anomalies in equipment usage, idle time, or productivity metrics.

These issues matter because they directly threaten project profitability, timelines, and stakeholder confidence.

Best AI agents for construction finance management and anomaly detection can automate invoice reviews, flagging duplicate or inflated subcontractor invoices or fees. Additionally, they can be involved in monitoring material costs by comparing procurement costs with market data and forecasts.

One of the most significant advantages of such AI automation services is their flexibility. With some training and developer involvement, construction companies can scale up budget tracking and operational anomaly detection, utilizing available datasets and real-time updates in specialized systems. As a result, such virtual assistants can continuously monitor project budgeting and workflows, alerting managers about emerging overruns or abnormal resource utilization.

With anomaly detection embedded into project management and cost control systems, construction leaders can catch red flags early, maintain tighter financial discipline, and deliver projects with greater predictability.

The Future of Anomaly Detection with AI

It may be too soon to discuss the potential evolution of AI anomaly detection solutions and the features they could offer in the future. However, it is an undeniable fact that anomaly AI integration is an emerging trend.

Currently, a limited number of companies from various fields already utilize such systems internally. Moreover, even these pioneers don’t currently use the full potential of such technologies. Still, it is apparent that more and more companies will start shifting from statistical SaaS to ML and AI anomaly detection due to the countless advantages of such methods.

Furthermore, as organizations continue to digitize their finance operations, AI anomaly detection will shift from a defensive measure to a strategic enabler, empowering leaders to manage risks, protect assets, and optimize performance.

How to Integrate AI Anomaly Detection with Incora?

AI anomaly detection is no longer optional, at least in finance and cost control. It is a competitive necessity that significantly enhances the efficiency and accuracy of operations such as mistake or fraud prevention, as well as other related tasks.

Ultimately, combining machine learning and AI algorithms with popular statistical models can yield even better results in preventing fraud, minimizing costly errors, and maintaining tighter control over budgets.

From banking to construction, anomaly detection agents are transforming financial oversight into a proactive, intelligent process that safeguards profitability. If you are interested in such integration or wonder whether this solution can benefit you, please contact us. We will gladly examine your particular case, suggesting the best way to enhance your operations, fitting even the tightest budgets or deadlines!

What’s your impression after reading this?

Love it!

33

Valuable

24

Exciting

6

Unsatisfied

1

FAQ

Let us address your doubts and clarify key points from the article for better understanding.

What is anomaly detection?

Anomaly detection is the process of identifying items or events in data that deviate significantly from normal patterns or expected behavior.

What technologies are used in anomaly detection?

Common technologies include machine learning algorithms (like clustering, autoencoders, and time-series models), statistical methods, and rule-based approaches.

What are AI agents for anomaly detection?

AI agents for anomaly detection are software systems that use advanced machine learning to autonomously monitor data, identify outliers, and trigger alerts in real time.

Can anomaly detection prevent problems or only detect them?

Anomaly detection primarily identifies issues early, enabling organizations to take action and often prevent problems from escalating, rather than just reporting them.

YOU MAY ALSO LIKE

Management Systems

Construction Project Management Software for Small Business: Complete Guide

Construction

How AI Negotiation Agents Improve Construction Procurement [And Why Do You Need It]

Construction,

Real Estate

How Construction Workflow Management Software Helps to Reduce Costs and Boost Efficiency?

Construction

How Integrated BOQ Software Bridges the Gap Between Construction Departments

Construction

How to Create a Procore Alternative Software for a Construction Business

Construction

How to Deal With Weaknesses of Construction Financial Management Software?

Real Estate

How to Select the Right Construction Management Software for Your Business

Construction

Investing in the Right Construction Reporting Software: Features That Make a Difference

Construction

Is Voice Technology Worth the Investment for Construction Firms?

Construction

Overcoming Integration Challenges: Making Construction Data Work Together with BI Tools

Management Systems

Simple Construction Software for Construction Planning: Case Study

Let’s talk!

This site uses cookies to improve your user experience. Read our Privacy Policy

Accept

Share this article