Construction

How to Deal With Weaknesses of Construction Financial Management Software?

July 11, 2025 • 105 Views • 21 min read

Bohdan Vasylkiv

CEO & Co-Founder

Construction financial management is one of the most significant pain points in construction management software, particularly with ready-made software-as-a-service solutions.

The number of reasons for such weakness in built-in construction accounting tools is numerous, ranging from the industry-first approach of construction SaaS to the complexity of these platforms, as well as the specific requirements of construction financial management.

To find ways to deal with construction finance management, we must first identify the core issues related to such operations and the reasons they occur.

Technical Limitations of SaaS Solutions

The most crucial aspect that directly impacts the inefficiency of financial management and tracking, as offered by popular construction SaaS platforms such as Procore, Aconex, or their alternatives, is the multi-purpose nature of these systems.

Simply put, these software solutions are designed to provide multiple features and services, covering a wide range of construction-related processes, or even offering end-to-end management. Such system complexity makes SaaS providers choose and prioritize between:

- Creating a multi-purpose functionality service to assist businesses with each process on a basic level, like automating repetitive tasks in each of the construction niches.

- Developing a solution with limited industry coverage, yet with extensive and highly detailed tools, that can completely cover one or a few processes, such as finance, project management, etc.

Unfortunately, it is challenging and resource-intensive to combine both approaches in a single system. Furthermore, such a project would require specialized expertise and compliance with multiple laws and regulations simultaneously.

As a result, even if such a SaaS solution were hypothetically possible to design and develop, it would likely fail as a business model, as the subscription fee would be too high compared to alternatives, such as interconnected SaaS solutions. Not to mention the challenges of maintaining such a complicated system.

So, off-the-shelf software creators commonly prioritize a particular niche or industry, such as construction, by researching common issues and offering their solutions. And only after a successful start can they proceed to gradually scale the existing SaaS, adding new features or enhancing existing functionality.

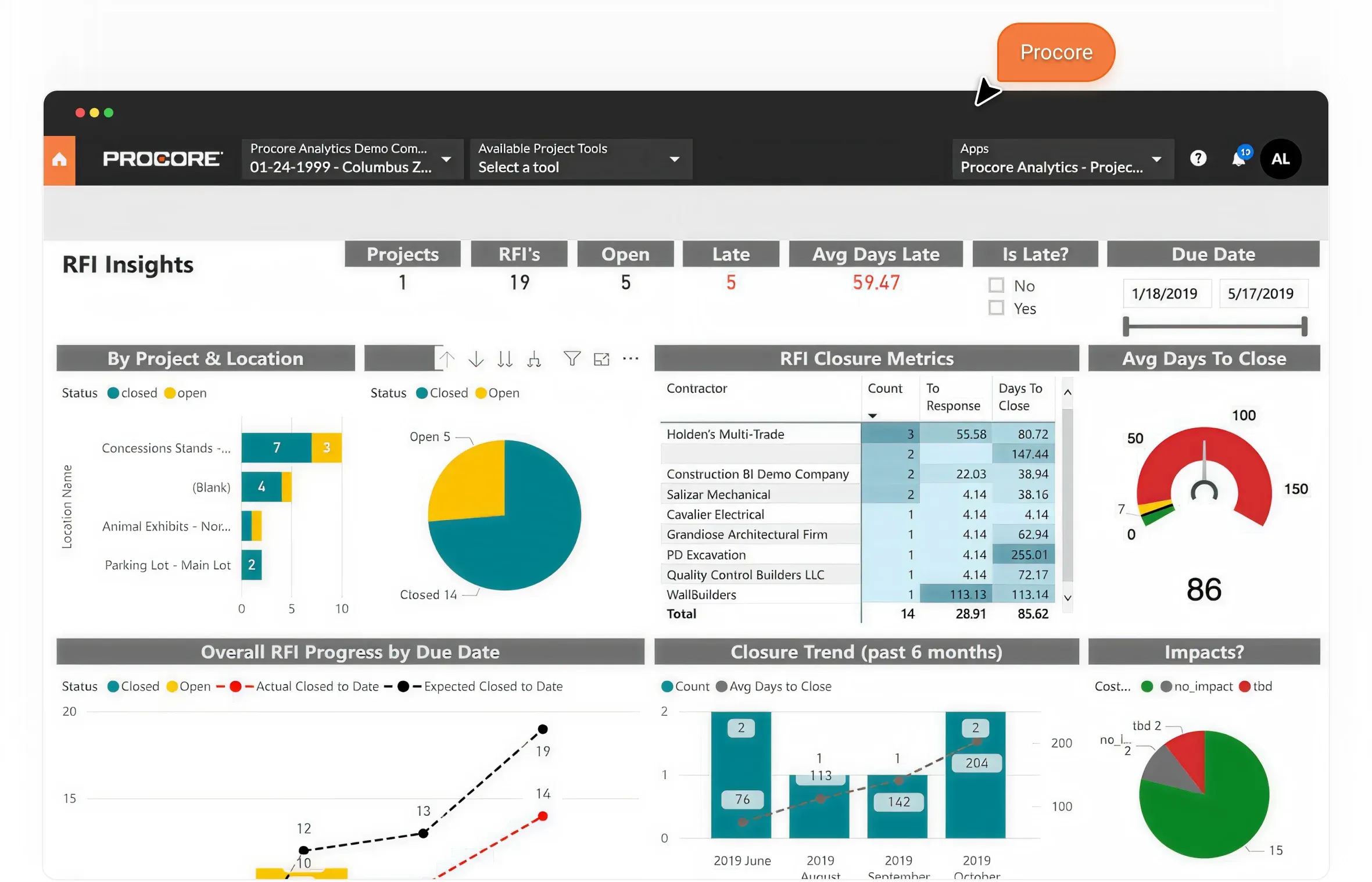

A notable example is Procore construction management software, which, according to our research, offers the most comprehensive set of features and IT services for construction industry. This software is an end-to-end system that covers all essential stages and operations of any construction project, such as:

- Preconstruction phase

- Project management

- Field collaboration

- BIM and visualization

- Analytics and reporting

- Centralized documentation

- And, of course, financial management

Yet, it is possible to grade these categories from best to least efficient, based on user feedback and reports, as well as the overall functionality:

Clearly, as a project management software designed specifically for the construction industry, Procore’s solutions for project management, preconstruction, and field collaboration are industry-specific, making them the top priority and requiring the highest detail.

On the other hand, financial management and analytical tools were added as supplemental features, linked to the primary services. AI and automation are rated low because they are relatively new features that are still under development and optimization.

A low rating for customization can be attributed to the overall complexity of the existing system, which makes it less flexible and adjustable. However, low appreciation of BIM and visualization services is the most surprising and worth consideration, as it is the only low-rated software feature for the construction industry. However, it can be attributed to poor optimization and integration issues.

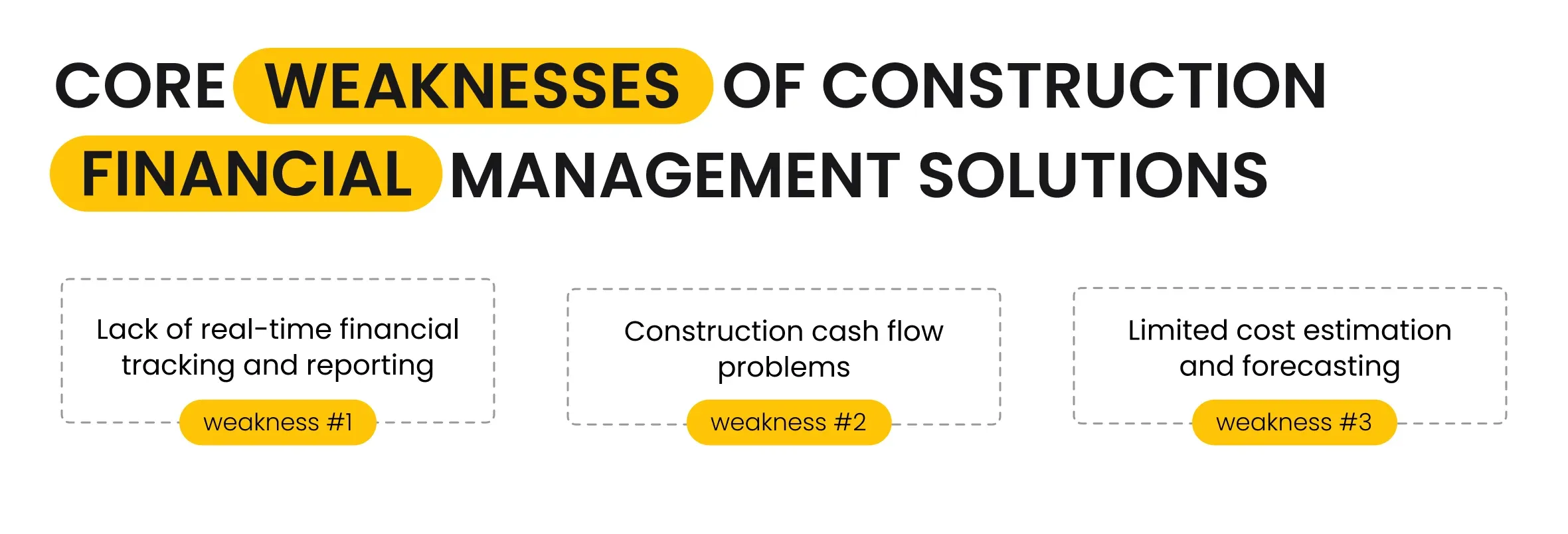

How We Evaluated the Procore Services?

- Data Sources Used:

User Review Aggregators: Platforms like G2, Capterra, and TrustRadius, where users rate Procore’s features (often on a 1–10 or 1–5 scale). Industry Analyst Reports: Rankings and commentary from construction tech analysts (e.g., Forrester, Gartner, JBKnowledge). Customer Case Studies & Surveys: Insights from published case studies, survey data, and feedback on specific modules. Procore Community & Forums: Discussions highlighting satisfaction, pain points, and feature requests.

- Scoring Criteria: Each category was evaluated on the following weighted criteria (example weights in parentheses):

- Normalization & Calculation:

Step 1: For each criterion, scores were normalized to a 1–10 scale. Step 2: Weighted averages were calculated for each category using the above weights. Step 3: The resulting “combined score” reflects both quantitative data (like average ratings) and qualitative insights (like analyst commentary and user feedback).

- Final Adjustments:

Scores were rounded for clarity. Outliers (e.g., categories with very few reviews or new features) were adjusted based on expert consensus and recent trends.

Nevertheless, the construction management system’s complexity and low prioritization of financial management services are not the only reasons for weaknesses of such features in construction SaaS.

Example Calculation for “Project Management”

Suppose the following (hypothetical) normalized scores: User Satisfaction: 9.4 Feature Completeness: 9.2 Functional Maturity: 9.5 Integration & Impact: 9.3 Adoption & Relevance: 9.4 Combined Score = (9.4 × 0.35) + (9.2 × 0.25) + (9.5 × 0.15) + (9.3 × 0.15) + (9.4 × 0.10) Combined Score = 3.29 + 2.30 + 1.43 + 1.40 + 0.94 = 9.36

Common Weaknesses of Construction Financial Management

First of all, built-in construction financial management services can’t compete with specialized FinTech solutions like SAP or Sage X3 for the same reason: they are industry-specific software that prioritizes the most needed and demanded services, defined by business goals and TA requirements.

So, while fintech software offers a more complex and specific toolset for accounting specialists, construction finance management covers just a few particular aspects, like:

- Lack of real-time financial tracking and reporting

- Construction cash flow problems

- Limited cost estimation and forecasting

Lack of Real-Time Financial Tracking and Reporting

Any data-driven process, such as decision-making, financial tracking, and reporting, commonly suffers from the same reasons, including:

- Manual data entry and updates

- Highly fragmented and siloed data

- Poor integration and synchronization between the systems

The adoption of software solutions can cover each of the foregoing. Nevertheless, the efficiency of software-driven data operations highly depends on the quality of software development or integration.

Custom software development involves a tailored approach, enabling the software team to perform all necessary steps to ensure the accuracy and efficiency of automated data synchronization or updates. It can either imply the development of standalone features or creating an entirely new, complex solution, such as a CRM for real estate from scratch.

At the same time, many construction SaaS solutions regularly offer financial and accounting management tools as a service, yet judging from user feedback and reports, such built-in features are commonly accompanied by bugs and other issues.

For instance, previously mentioned Procore provides its customers with built-in finance management systems that can be synchronized with professional fintech solutions. Nonetheless, such inter-system integration commonly causes issues, resulting in poor data sync, making manual data updates more preferable.

Using software solutions can not only ensure seamless financial data synchronization between different management systems but also offer solutions for streamlined data operations, reducing the manual workflow. As a result, construction businesses can:

- Lower the workload on their employees by reducing the number of manual tasks and automating repetitive processes, allowing their staff to work on more prioritized assignments.

- Avoid potential mistakes and errors due to human factors by templating and standardizing data updates, as well as streamlining the process.

- Enhance financial management and budgeting by utilizing up-to-date information for accurate estimation and corrections.

Construction Cash Flow Problems

Cash flow management is one of the most common challenges in the construction business. There are numerous factors to consider, including arrangements with contractors and subcontractors, market and material price fluctuations, delayed payments, or extended project timelines, all of which can negatively impact cash flow.

Apart from this, due to the high prevalence of inefficient planning tools and the need to manually update expenses, construction companies commonly face inaccurate budgeting.

The most effective way to address the foregoing issues is to implement real-time cost tracking with bill of quantities (BOQ) comparison, as well as adopt an integrated project workflow.

As mentioned above, most construction SaaS solutions offer some form of financial services, including one-way or two-way synchronization and integration with professional fintech solutions. However, the basic built-in integrations are limited and struggle with optimization and performance, showing regular bugs and errors.

However, it is possible to upscale and fix such SaaS integrations with the help of custom software development services. In such cases, a dedicated development team can examine the issues with third-party integrations and find a solution that involves either adjusting existing cooperation methods or implementing a new, from-scratch solution.

Limited Cost Estimation and Forecasting

Ultimately, cost estimation and forecasting are essential components of any financial planning and management process. However, most modern businesses still perform them in an outdated and primarily manual manner, with the assistance of dedicated specialists.

Yet, modern software solutions can also help to streamline such operations, making them more accurate and data-based. One of the most prominent software-driven solutions for such purposes is artificial intelligence integration.

Many construction SaaS systems have adopted AI and ML models for multiple purposes, including financial ones. However, as our Procore limitations research from above shows, the offered AI and automation solutions are the least efficient among all the features and services provided by the platform.

The explanation, once again, is simple: these are not the primary functionality they offer to the clients. So, such features are treated as “extra” options, which may become more accurate and coherent in the future.

Alternatively, we suggest considering custom software development for integrating such functionality, as seen in one of our latest cases, which involved integrating an AI module into a construction ERP to enhance customer support services.

Despite the task specifics, the overall AI implementation process would be similar for cases when you want to use it for progressive cost estimation and forecasting. The primary difference between these models lies in the training stage and the type of data used.

Yet, such tools can be used at every project stage, starting with pre-construction planning and estimation, utilizing historical data from your previous projects. As a result, your business can make much more accurate and detailed predictions, enhancing the work of your analytical department.

How to Overcome Financial Limitations in Construction Software?

Frankly, AI integration or optimization of existing systems is not the only option to overcome existing financial issues in the construction industry. There are two primary ways to address such restrictions and enhance the efficiency of construction financial management:

- Custom Feature Integration

- Third-Party Integration

Custom Feature Integration

We highly suggest considering this cooperation model because it is a tailored approach that guarantees meeting your business needs and goals.

Long story short, in terms of such cooperation with a technical partner, all you have to do is introduce your budget and functional expectations. As a result, the development team will choose a tech stack and integration options that will meet both your goals and limitations.

For example, you can contact us now to describe your needs and project ideas, as well as provide the basic requirements. Our specialist will perform a rough estimation and present it to you, explaining what you can achieve with the available resources.

Additionally, we can offer alternative solutions if your goals are unattainable with a limited budget or if your existing software lacks essential features or services.

NOTE: A Custom software development approach doesn’t always involve creating new systems from scratch. Many such projects typically involve creating standalone features, such as AI modules, or setting and adjusting existing software, conducting code reviews, and implementing optimizations.

Third-Party Integration

This approach is similar to custom integrations. The core difference between them lies in the toolsets used: while custom solutions incorporate at least some custom-made elements and features, third-party integration can also involve coding practices. Still, the primary goal of such an approach is to utilize ready-made services and bypass the development process itself.

Simply put, coding and other software development activities aim to ensure a seamless and efficient integration between two independent software systems or applications. The creation of entirely new functionality is limited in such cases and typically serves only to facilitate successful integration (if necessary).

Additionally, such third-party integration projects occur more frequently than custom development. A prime example is the integration of the Procore construction management system with fintech solutions like Sage X3 or SAP.

As you can see, these systems serve completely different tasks and offer distinct features; for instance, Procore cannot replace Sage X3, and vice versa. However, they can still use the same data, such as construction billing or procurement. It is possible to enable data synchronization between these platforms using specialized tools.

Best Practices for Effective Construction Financial Management

Summarizing all the above, the core issues in construction financial management stem from extensive manual processes, a lack of automation for repetitive tasks, and inadequate data synchronization.

Therefore, the best practice for efficient construction financial management is to optimize and improve the overall management system, ensuring it provides your team with convenient and useful tools for data management, which can also facilitate the synchronization of financial data between independent systems or other solutions.

For example, among the most widespread pain points in construction software that can affect your construction financial management are:

- Inaccurate Budgeting Due to Manual Planning Tools

- Lack of Analysis at the Pre-construction stage

- Outdated Project Execution

- Disconnected Coordination Within PM Tools

Once again, data synchronization and integration of various systems, as well as some custom features like AI implementation, are among the most efficient and affordable services that can easily overcome the issues mentioned above and enhance the efficiency of budget planning or accounting.

For more details, you can always refer to our latest industry-specific case studies, which demonstrate how software solutions help businesses succeed.

What’s your impression after reading this?

Love it!

19

Valuable

5

Exciting

3

Unsatisfied

1

FAQ

Let us address your doubts and clarify key points from the article for better understanding.

How does poor financial management affect construction project outcomes?

Poor financial management in construction can lead to budget overruns, project delays, cash flow issues, and even project failure, ultimately damaging profitability and stakeholder trust.

What features should I look for in construction management software?

Key features to look for in construction management software include project scheduling, budget tracking, document management, real-time collaboration, equipment and resource tracking, and reporting tools.

Can construction financial management software integrate with accounting systems?

Yes, construction financial management software can integrate with accounting systems to sync budgets, expenses, invoices, and payroll—ensuring accurate, real-time financial data across platforms.

How can automation improve financial processes in construction management?

Automation can improve financial processes in construction management by reducing manual data entry, minimizing errors, accelerating invoicing and payments, and providing real-time budget tracking and financial insights.

YOU MAY ALSO LIKE

Management Systems

Construction Project Management Software for Small Business: Complete Guide

Construction,

Real Estate

How Construction Workflow Management Software Helps to Reduce Costs and Boost Efficiency?

Real Estate

How to Select the Right Construction Management Software for Your Business

Management Systems

Simple Construction Software for Construction Planning: Case Study

Real Estate

Clutch: Incora Is Among the TOP 10 Best Real Estate Software Development Companies Worldwide!

Must-Have Features for Successful Real Estate Mobile App Development in 2024

Real Estate App Development vs Web Development: Which is Right for Your Business?

Let’s talk!

This site uses cookies to improve your user experience. Read our Privacy Policy

Accept

Share this article