FinTech

How Third-Party APIs Can Upscale Your FinTech App

November 10, 2023 • 346 Views • 16 min read

Tetiana Stoyko

CTO & Co-Founder

Nowadays, technological evolution has resulted in an increased number of various product development services. Unlike before, you can skip some crucial development processes, and get straight to your main goal.

To simplify it, if you wanted to design an online banking app 40 years ago, you had to take care of each implementation stage, starting with planning and in-house team gathering, and ending with developing each single step on your own. No wonder, why the first owners of such FinTech software development services were mainly gigantic corporations from the finance industry.

Fortunately, today the situation on the market is much more convenient, and even smaller companies can develop various FinTech software without the need to spend so many resources, as before. Besides, it become possible to choose nearshore development, or find offshore software development teams instead of hiring in-house developers.

For instance, with the popularization and spread of the Internet in a globalized world, product owners can outsource their projects and, for instance, hire a dedicated development team from Eastern Europe, which will be cheaper, yet still as productive and qualitatively, as an in-house team from the United States.

However, the true advantage of modern circumstances, compared to the old times, is the fact, that there is a wide range of various ready-made software solutions, which are distributed as SaaS and can be easily integrated into any type of application with just a relatively small fee.

So, what is Third-Party API, what are the benefits and drawbacks of using such a solution, and how to choose the best Third-party API integration for your FinTech software development?

Third-Party FinTech API in a Nutshell

First things first, let’s talk about the API phenomenon, to better understand, how exactly such software works.

Application Programming Interface, or simply API, is a method, that is used to enable the communication between different types of software, allowing to use of particular functionality and features of a ready-made product, without the need to develop one.

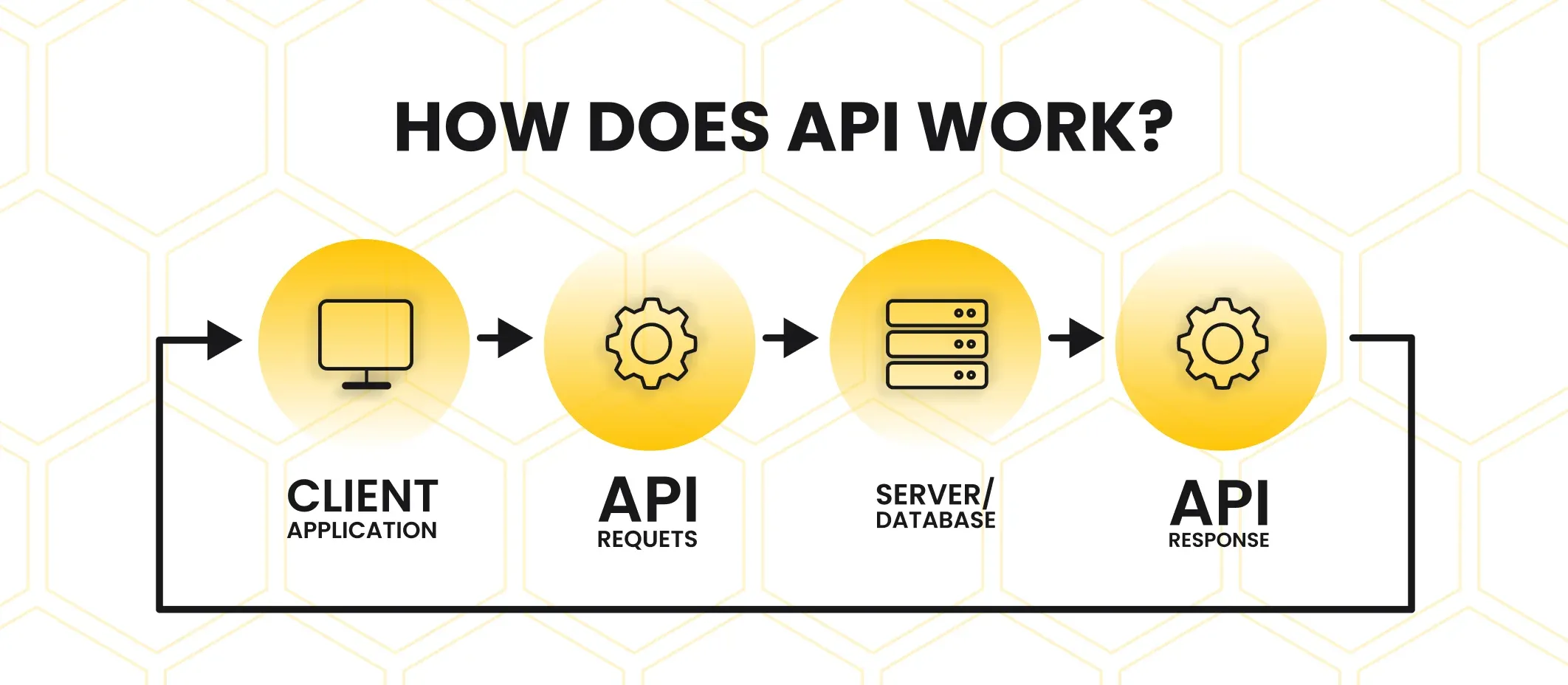

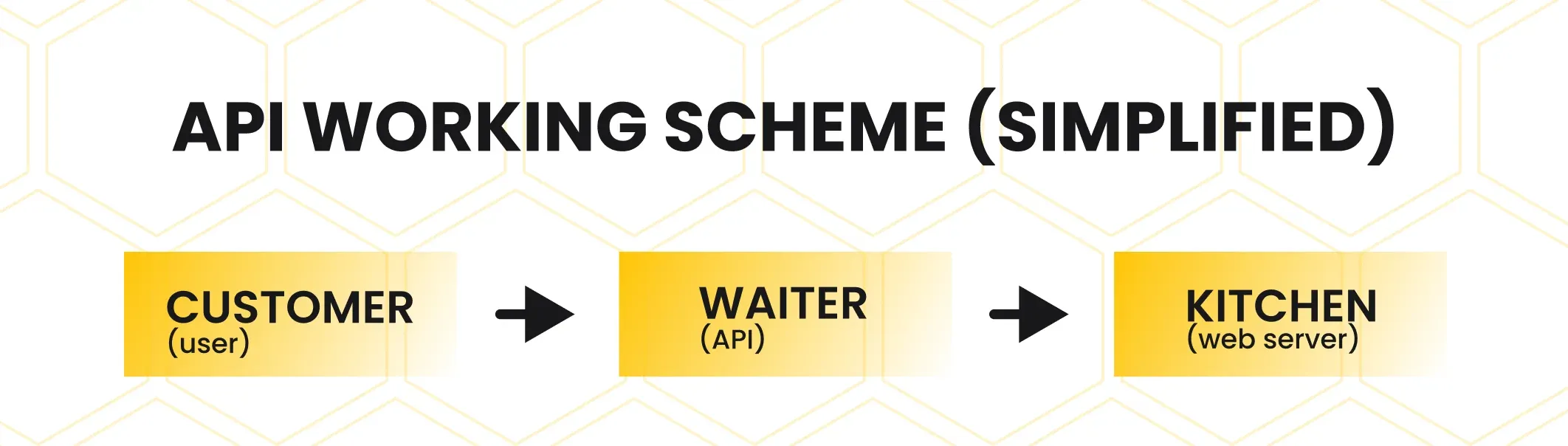

To make it simple, it operates due to the quest-response principle. In terms of API, there are at least two different actors: client and server.

So, if you have an API integration in your product - you are on the client side. Each time, when you need certain data or features, your app sends a request to the original application, which API you are using, and, thereafter, is known as a server.

After it receives your request, the server “packs” all requested data and sends it back to the client.

Clearly, all the foregoing is an oversimplified scheme, which ignores numerous facts and details, yet allows us to clearly understand all main working principles of API technology.

The “third-party” element we use to additionally highlight the fact, that we are talking about the possibility of integrating applications and functionality, developed and distributed by other people or FinTech companies.

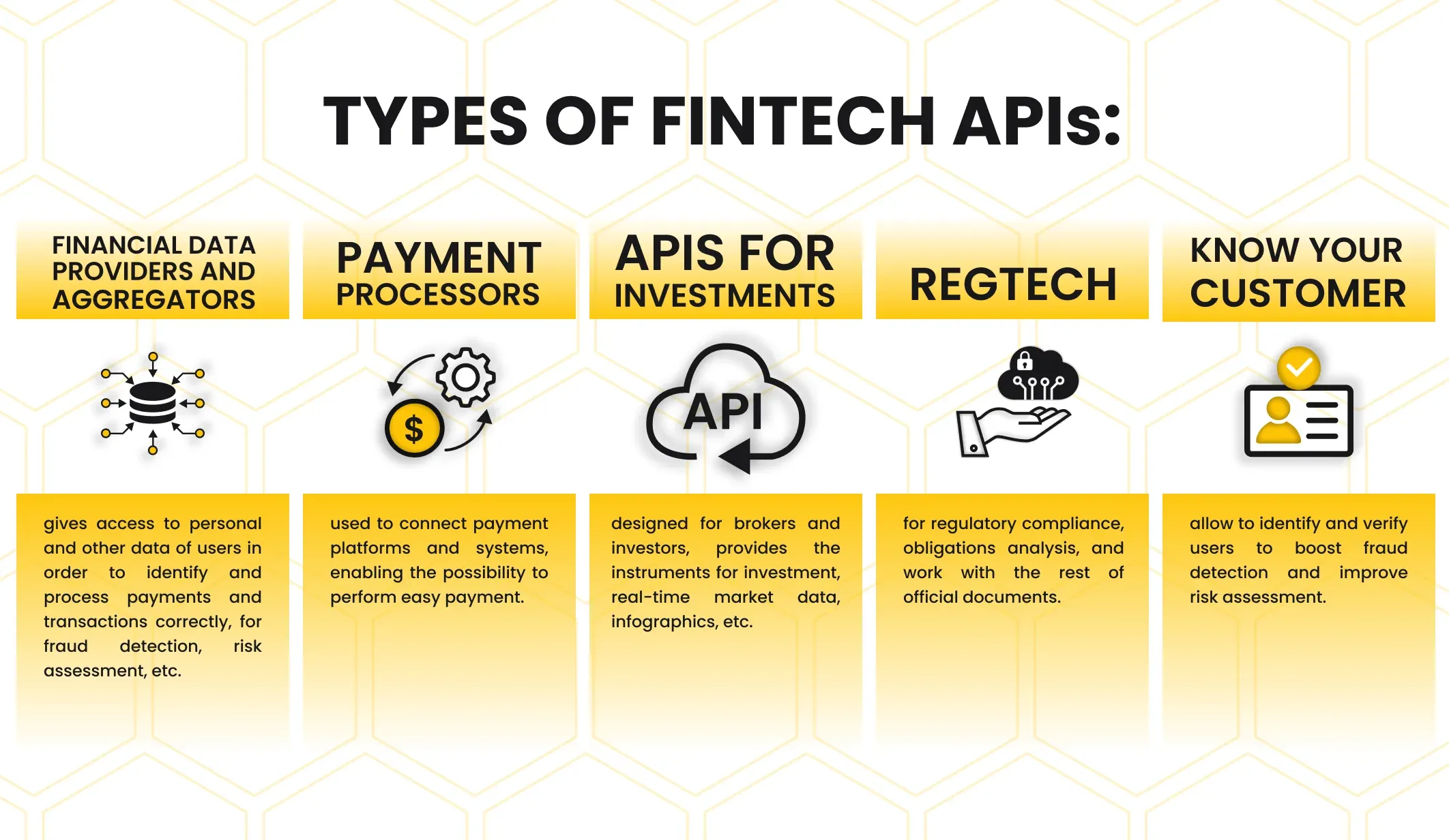

What is so Special about FinTech APIs?

Frankly speaking, when it comes to specific types of APIs, like the FinTech application programming interface, we have to admit, that they might have some usage specifics, which are related to the industry, you are working with.

Obviously, FinTech software development APIs are more demanding due to the security protocols, required in this field.

It is not a big secret, that FinTech applications regularly work with the personal information of their users, as well as have access to vulnerable information, like money transfers, etc. Thus, they have more restrictions and related governmental regulations, that must be followed.

As an example, these APIs need to follow the well-known OWASP list and take care of all these potential threats. At the same time, for some of the other APIs, it is rather a recommendation to ensure a high level of security.

Why Use Third-Party FinTech APIs?

There are at least a few major benefits of considering and adopting such ready-made features:

It is much cheaper.

Undeniably, most modern FinTech software development APIs are paid, i.e. you will have to sign an agreement with its owner and pay a certain fee for using it. Yet, in most cases, such services are still cheaper, if you compare them with your spending on a full-scale feature development process. Additionally, it also allows you to skip the need to maintain and update the integrated functionality feature - it must be done by your third-party provider.

It is much faster.

Another noticeable advantage of implementing ready-made features and software solutions is saving time. It is hard to deny, that integration, even if it will require some coding, is a much easier process. As a result, business owners can save time and resources(at least the hourly rate of the developer) by simply choosing to integrate a ready-made solution.

Access to complex technologies.

Eventually, among the most basic benefits of third-party FinTech APIs, we also can name the possibility of using a more complex tech stack, which might require extra software engineers. Clearly, not all developers are familiar with all the available technologies. So, sometimes, when a feature requires a very specific and complex technological approach, you can avoid the need to hire a niche-experienced remote software development team, instead of using a ready-made app.

Summing up all the above, it is clear, that third-party FinTech APIs can significantly improve and simplify your software product, giving access to some functionality and skipping the process of development, which might vary in time, depending on how complex and scalable the functionality is.

However, there are some challenges to using such a development approach as well.

Challenges of Using Ready-Made FinTech APIs

The most important aspect, worth remembering and considering, is the fact, that with the benefits it brings some limitations and potential issues, like security policies, or access to data, as well as other API vulnerabilities.

Security Threats

It highly depends on your purpose to use financial APIs.

For example, if you want to integrate a payment gateway in the form of API for your eCommerce platform, or food delivery app, - then it is not as crucial for you.

However, if you are considering developing a full-fledged financial platform for blockchain, or online banking - then, you will have to be 100% sure of the reliability of your potential service provider, because in such case, you will have to work directly with much more essential and private data and protocols, which significantly upscales the risks of sharing them with a third party.

No Access To the Admin Panel

As was mentioned before, most of these APIs are distributed as a service. As a result, you, as a client, will have limited or even no actual access to the database or the admin panel of this service.

It may result in situations when you need to access some data or processes on the admin side, yet won’t be able to do so, at least, as fast, as it would be if you had this feature developed by your team.

The same is true for the cases when you want to extend the functionality. Clearly, all such changes or improvements, related to the features, proposed as APIs, are possible only for their providers. As a result, you will need either to agree with your service provider for functionality extension or to look for the rest alternatives, which can satisfy your needs.

A List of Most Popular FinTech API Solutions

To better illustrate how and for what you can use third-party APIs, we decided to make a brief list of the most common and popular choices among financial institutions.

PayPal REST APIs

PayPal, a global company, created one of the most well-known online payment systems and digital wallets, which significantly improves the app user experience, proposing a wide range of useful tools and features for their customer experiences worldwide.

However, apart from that, PayPal also provides a great toolset for the rest of financial businesses, interested in innovative technologies. One such functional feature is PayPal REST API collection, which makes it possible not only to use P2P transactions but to set up other specific processes like webhooks, financial transaction history with the ability to search through, subscription management, product catalogs, and many other features.

The reputation of PayPal company, combined with its rich experience in the FinTech industry, makes it one of the most popular and common API service providers. Still, despite numerous additional API services, the most well-known and used one is the PayPal Payments API.

Stripe API

Another popular solution, used worldwide as a payment method is Stipe API.

While PayPal is mainly associated with Peer-to-peer transactions, Stripe is known as a great financial infrastructure for eCommerce, which allows it to perform full-fledged Internet commerce, distinguishing “personal” and “business” accounts.

To make it simple, Stripe is one of the best payment gateways in the modern eCommerce market, which is commonly integrated into the related platforms from this field. So, it allows the owners of internet marketplaces to easily enable payment solutions, and to pay more attention to the rest functional aspects, worth considering.

Syncfy API

Unlike the previous examples, Syncfy API is not used as a payment processor or online banking service, at least not in the same way.

As a matter of fact, Syncfy API gives its clients the ability to easily access financial and other vulnerable data, straight from numerous financial institutions securely and simply.

This financial technology gives various data points, which helps to better understand and identify the current user.

Mainly, this functionality is used for fraud detection and risk management, as well as person identification.

Blockchain Exchange API

Finally, it is also worth mentioning various APIs, related to the cryptocurrency and blockchain industry.

It includes API from various cryptocurrency marketplaces, which enable fast and convenient way of crypto exchanges, tracking and monitoring of various processes and data, like price changes, real-time infographics, and other tools for understanding the trends.

For instance, Blockchain Exchange API is a full-fledged package, with numerous instruments, designed specifically for those, who are aiming to take part in cryptocurrency trading.

Alternatively, you can use this API to enable Bitcoin payments on your website and send or receive digital assets to Blockchain wallets.

Frankly speaking, the foregoing is just a limited list of possible third-party FinTech software development APIs. We should also mention various technologies, distributed as SaaS APIs, created for management and monitoring, improving security policies, allowing stock trading, and many others. Still, this short list allows us to understand better the overall tendencies and functionality of FinTech API case studies.

FinTech API Integration with Incora

To make it simple, third-party APIs are a powerful tool, which makes it possible to design and develop almost any type of software application. It significantly speeds up these processes and makes it possible even for small companies to develop a complex and scalable product, without the need to take part in numerous development cycles and maintain or update all these features.

Still, the variety of FinTech APIs, as well as countless differences and details makes it much harder to figure out, which service is going to be the best for your idea.

Therefore, we recommend you find and hire dedicated development team of niche-experienced offshore developers, who can advise you on which solution to choose and can easily perform all the code-related processes, as well as other adjustments for the best possible usage experience.

If you are truly interested in upskilling your app but avoiding overcomplicated processes and comparisons - contact us, and we will gladly do it for you. But before - check our case studies, to ensure our expertise in this field, and to better understand the benefits of collaborating with Incora.

What’s your impression after reading this?

Love it!

1

Valuable

1

Exciting

1

Unsatisfied

1

FAQ

Let us address your doubts and clarify key points from the article for better understanding.

What are Third-Party APIs in the context of FinTech?

Third-Party APIs (Application Programming Interfaces) in FinTech refer to external software components or services that can be integrated into your financial technology application. These APIs are provided by external entities and offer functionalities like payment processing, financial data aggregation, identity verification, and more.

How can Third-Party APIs enhance the functionality of my FinTech app?

Third-Party APIs can augment your FinTech app by providing specialized features and services. For example, integrating a payment gateway API enables secure and seamless transactions, while a data aggregation API can offer comprehensive financial information, enhancing the user experience.

What types of Third-Party APIs are commonly used in FinTech?

Common Third-Party APIs in FinTech include payment gateways (e.g., Stripe, PayPal), financial data APIs (e.g., Plaid, Yodlee), identity verification APIs (e.g., Trulioo, Onfido), and blockchain APIs (e.g., Coinbase). These APIs cater to various needs such as transactions, data insights, security, and blockchain integration.

How do Third-Party APIs contribute to the scalability of a FinTech app?

Third-Party APIs streamline development by allowing you to leverage pre-built functionalities. This reduces the time and resources required for in-house development, enabling your FinTech app to scale more rapidly. Additionally, these APIs often handle complex processes, freeing your team to focus on core features and innovation.

Is it safe to integrate Third-Party APIs into my FinTech app?

Yes, but it's crucial to choose reputable and secure APIs. Prioritize APIs with strong security measures, such as encryption, authentication, and compliance with industry standards. Always review the documentation and consider the reputation of the API provider to ensure data security and regulatory compliance.

How can Third-Party APIs improve user experience in a FinTech app?

By integrating Third-Party APIs, you can offer users a more comprehensive and seamless experience. For instance, using a geolocation API for transaction verification enhances security, while incorporating financial data APIs provides users with a holistic view of their financial status, promoting better financial decision-making.

YOU MAY ALSO LIKE

Let’s talk!

This site uses cookies to improve your user experience. Read our Privacy Policy

Accept

Share this article