FinTech

How Neobanking Market Affects Software Development Trends

May 17, 2022 • 320 Views • 12 min read

Bohdan Vasylkiv

CEO & Co-Founder

As a matter of fact, the innovations have enabled the transition into the virtual world. It means, that all of the routine tasks are becoming online. Because of the popularity and the spread of the Internet as well as its convenience, it is considered a tool for improving the services of different industries. FinTech is not an exception but the proof.

For example, most banks have online banking services, that allow using online payments and checking the balance of the card, etc. Credit and debit cards are also using the internet for payments. The money, used for online payments, is basically virtual. Nevertheless, all of the “virtual” money is physical and stored in the vault. Even though regular banks provide online services, the neobanking market is rapidly growing, so what is it, and how exactly does the neobanking market shapes the fintech software development trends?

The Difference between Online- and NeoBanking

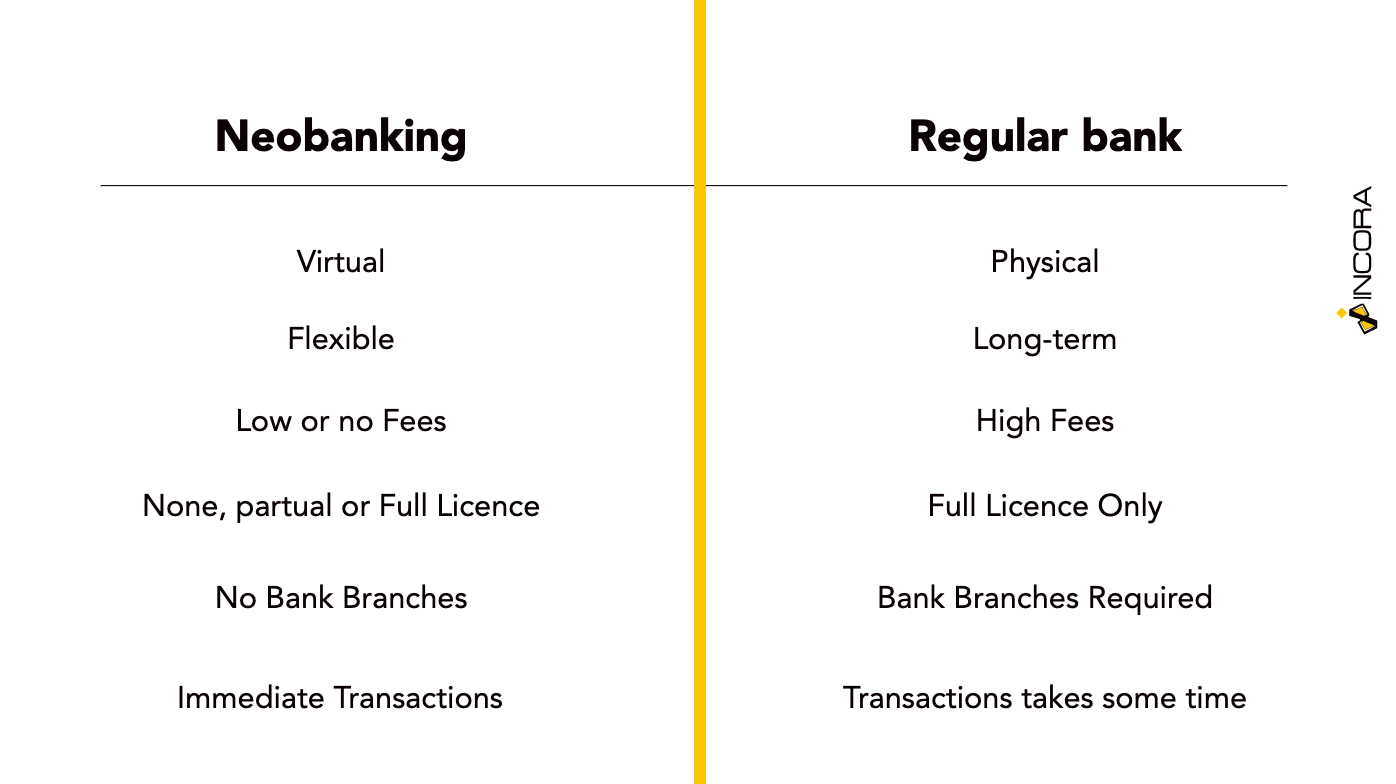

The major difference is that neobanking has no physical branches and is fully virtual, while online banking is just an additional service of a regular bank. Also, the neobanking sometimes can have accreditation, while the regular one is forced to have it. This creates opportunities as well as limitations. For example, most such banks have no insurance, so using them seems riskier, which scares possible clients. Moreover, there is no guarantee that neobank can become bankrupt or closed, so your money will be lost.

Nevertheless, the neobanking provides a lot of various pleasant features such as low commission, cashback, etc. Moreover, because the neobanks have no branches or own ATMs, they allow cash withdrawal and other actions with the card balance without any additional payments.

In fact, the main difference between regular and neobanks is that the second ones are existing virtually. Also, the neobanks are trying to become full-fledged banks as well. For this purpose, they are getting licenses from other banks as a branch using open banking APIs or independently. Anyway, neobanks have some drawbacks compared to standard banks.

First of all, they are working as a service, not the institution. This is why they have fewer features. Nevertheless, all the features they propose are working almost perfectly. As an example, money flow between neobank accounts is almost instantaneous, all the user need is to send a transfer, and the bank accepts it. At the same moment, the physical bank has to complete a few additional acts to check if everything is ok and get the confirmation of the transfer.

Also, to create an account in neobank the user needs access to the internet. The user can even have no physical card because all the features are possible to proceed by the phone. Even so, the user can order the production of the physical card. But the main instrument of interactions with the bank is the neobank application.

In UI/UX We Trust

The bank application is the main product of each neobank. Their main advantage is the user-friendly interfaces. In fact, they are providing the best product for mobile users. Also, the simplicity of the structure, compared to the regular banking system allows for fast updates and changes. In addition, the developers regularly ask for feedback from their customers, as well as consider various features that could help to improve the user experience.

For example, the communication can proceed through the different messengers and chatbots, which works like a simplified fintech AI thanks to open banking APIs, if the user wishes so. Actually, UX/UI is the most important aspect of the neobanking to consider.

Including the fact, that online and mobile banking are adaptations of regular banks, so these are not the only features to take care of. On the other hand, the neobank is based on these platforms, and the main way for neobank to compete with the others is to provide more convenient payment methods.

As was mentioned before, the users of the Neobank don’t need to have a physical card to operate their accounts. Thanks to NFC technology, mobile phones become mobile wallets. Mobile wallets are not only the feature but the actual independent software. Most modern phones, that are staffed with the NFC have an actual mobile wallet application, where all the bank cards and credentials can be added and used as a payment method.

Of course, mobile wallets were created to improve mobile banking. However, the neobanking market uses it as one of the most important instruments and features. Nevertheless, it is not the only powerful tool, that shapes the popularity of the neobanking market.

Cryptocurrency and Banking

The emergence of cryptocurrency and the development of blockchain technology have influenced the whole financial industry. Cryptocurrency is basically fully digital and innovative currency, there are almost no physical equivalents for it. Considering the fact, that it is still a currency, that can be used online-only. Also, crypto marketplaces and holders’ working processes are slightly similar to neobanking and mobile wallets ones. We can conclude that cryptocurrency holders are, in fact, the same as the neobanks. The main difference is the money, they are operating with.

Nevertheless, this gap is narrowing. The number of banks that accept cryptocurrency is increasing as well, so we can assume that in the nearest future neobanks will be implementing the blockchain technology too. As an example, Current, one of the neobanks, is considering launching cryptocurrency technologies.

Most of the neobanks have everything they need for using such technologies. The neobanking market is much safer, it is based online and definitely shapes the software development trends thanks to the flexibility of its structure. Because of the need to compete with other banks, the neobanking market has to be more innovative.

This is why neobanks develop and implement various modern technologies such as fintech AI or machine learning to provide better and faster customer support. Also, fintech AI can be used for analyzing the cryptocurrency markets and making predictions.

The neobanks are the first banks that accept cryptocurrency thanks to their virtuality and the need to compete. It creates great opportunities because the cryptocurrency market is out of moderation and the amount of money that circulates there is enormous.

Actually, blockchain technology is a great upgrade that is possible to be implemented into the neobanking market. In addition to the possibility of fully integrating cryptocurrency into the banking system, it helps to make all the transfers even more transparent and safe. Actually, there are a lot of similar aspects, that are common for both the neobanking market features and the blockchain technology.

Neobanking Market and Software Development Trends

At the moment it is hard to tell exactly how neobanking affected the software development trends. The neobanking is still considered new technology, given that it was embodied less than 10 years ago.

Nevertheless, it is already obvious that such an approach will change the whole industry. The need to compete with the system, that existed for thousands of years pushes the new players to search for alternative ways and approaches in the sector.

-

First innovation was to improve a BaaS approach, which stands for Banking-as-a-Service. Just like SaaS, BaaS enables using the banking services without developing them. It is possible thanks to open banking APIs, which enable the transparent sharing of banking information and credentials to third-party groups in a safe way.

-

The way how they affected mobile banking is incredible. The fact that neobanking is fully virtual and mostly device-based has made a great impact on this sector. For example, mobile wallets as well as mobile banking itself were not as popular before the neobanking appeared. Moreover, the emersion of neobanking made the regular ones improve their online and mobile services in order not to lose their audience and have an opportunity to compete with a new rival.

Read also: How much it cost to create an App?

-

To use and development of fintech AI. For example, the communication with the client was based on simple chatbots, which created some difficulties. The improvement of the chatbots with the integration of artificial intelligence and machine learning as well as enabling the usage of additional messengers improved customer services. Moreover, the fintech AI is becoming a regular tool for risk management, and various processes automation.

-

Enabling blockchain technologies and cryptocurrency. In fact, neobanks have all the chances to become the first banks that accept cryptocurrency on a regular basis. Moreover, thanks to their flexibility they are able to integrate existing blockchain technologies or develop new ones. According to the size of the cryptocurrency market, its growth, potential, and the amount of money that circulates inside, as well as difficulties to transfer it into real money or use it as a proper payment method. Moreover, it is possible to consider cryptocurrency holders and markets as neobanks, at least partly.

Of course, there is a lot of work to do even now. All these solutions and innovations are already developed. However, they are still being “polished” in order to perform even better results. Nevertheless, it is hard to argue that the neobanking market affects software development trends.

End Line

Summing up all the foregoing, we can say that neobanking is a very perspective industry worth considering. There are plenty of benefits and advantages of getting into this field right now, given that it is still evolving and developing.

Our development team would be glad to answer all the questions you may have. Moreover, we are willing to help you and be there for you in each development stage.

What’s your impression after reading this?

Love it!

1

Valuable

1

Exciting

1

Unsatisfied

1

FAQ

Let us address your doubts and clarify key points from the article for better understanding.

YOU MAY ALSO LIKE

Let’s talk!

This site uses cookies to improve your user experience. Read our Privacy Policy

Accept

Share this article